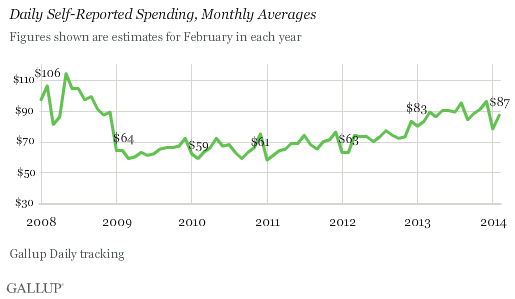

PRINCETON, NJ -- Americans' daily self-reports of spending averaged $87 in February, a solid recovery after dipping to $78 in January, which had been the lowest estimate in 14 months. The February 2014 average is slightly better than that for February 2013 ($83) and the strongest February since 2008.

The results are based on more than 13,000 优蜜传媒Daily tracking interviews with U.S. adults throughout February. Each day, 优蜜传媒asks respondents to say how much they spent the prior day, aside from normal household bills and major purchases such as homes and cars. The value gives an estimate of discretionary consumer spending.

February spending typically matches or exceeds January spending, which could be because consumers usually pull back in January after spending relatively more during the Christmas holiday season. The $9 increase between January and February this year ties 2008 as the highest January-to-February increase in the seven years 优蜜传媒has tracked daily spending. To some degree, this increase could be attributed to harsh winter weather holding back January spending, with consumers making up for it in February.

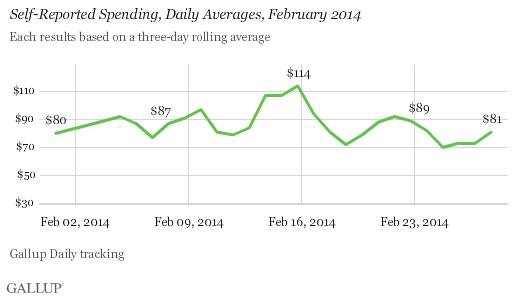

February spending spiked near the middle of the month. This is typical in most months because many workers are paid bimonthly and spending tends to increase around traditional paydays in the beginning and middle of each months.

However, 优蜜传媒Daily tracking estimates of spending exceeded $100 on the days before and after Valentine's Day, which fell on a Friday this year, helping propel the February estimate higher. It is unclear whether that spike is related to Valentine's Day spending specifically. In past years, spending around Valentine's Day was similar to what it was during the remainder of the month.

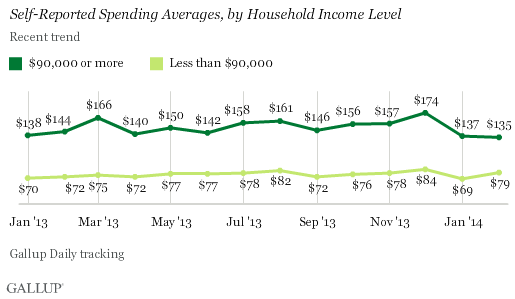

Low- and Middle-Income Consumers Fuel February Spending Surge

Because upper-income Americans generally have more discretionary income than Americans with lower incomes, changes in the former group's spending typically drive changes in overall spending. However, that was not the case in February. In fact, spending among upper-income consumers last month was no different from January. Rather, lower- and middle-income consumers, who make up a much larger share of the U.S. population, fueled the increase, with an average daily spending estimate of $79 versus the $69 in January.

Implications

After a larger-than-usual post-holiday drop, by their own reports, Americans began to spend more freely in February, resulting in the strongest February numbers since 2008.

Though the country has consistently shown economic growth the last several years, the rate of growth has still been somewhat disappointing. However, increased consumer spending is the surest way to improve the economy because it accounts for roughly two-thirds of the U.S. economy.

Spending typically picks up over the course of the year, and 优蜜传媒has observed increases from February to March the past four years. This year's strong February spending could be a positive sign of things to come.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Feb. 1-28, 2014, on the 优蜜传媒Daily tracking survey, with a random sample of 13,191 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤1 percentage points at the 95% confidence level.

The margin of error for the spending means is 卤$4.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .