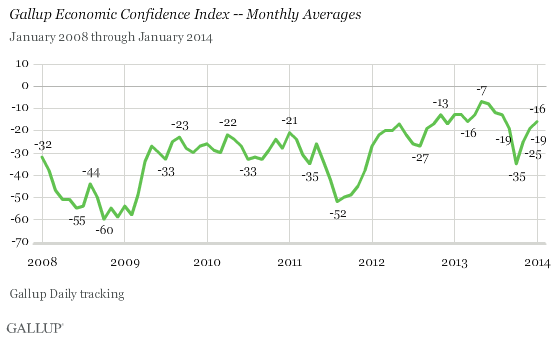

WASHINGTON, D.C. -- Gallup's Economic Confidence Index improved slightly for the month of January, climbing to -16 from -19 in December. Although a and negatively affected Americans' confidence in the short term, Americans' economic confidence improved for the third month in a row after dipping to -35 during the federal government shutdown in October.

Last month's rise in confidence may surprise some, given the dismal December statistics from the Bureau of Labor Statistics and the worst January performance from the Dow in five years, but Americans have continued to become more confident in the nation's economic circumstances since October's federal government shutdown.

The January results are based on 优蜜传媒Daily tracking interviews conducted by landline and cellphone with more than 15,000 U.S. adults.

The 优蜜传媒Economic Confidence Index is the average of two components: Americans' views on the current economic situation and their economic outlook. The current economic conditions component of the index averaged -18 in January, based on 18% rating the economy as excellent or good versus 36% rating it poor. The economic outlook component was -13 in January, with 41% of Americans saying the economy is getting better and 54% saying it is getting worse.

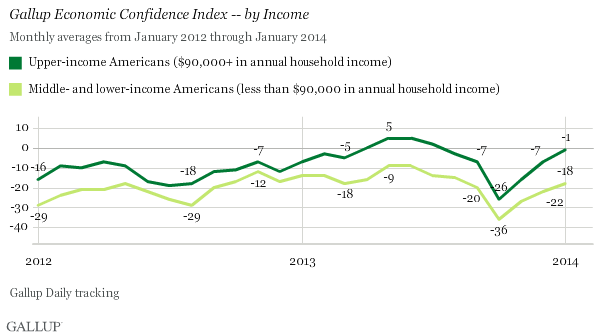

Upper-Income Americans at Highest Level of Confidence Since July 2013

Confidence among Americans with an annual household income of at least $90,000 reached -1 for the month of January, a peak it hasn't seen since July of last year. Though still a negative figure, it reflects a six-point increase from December's -7 reading. Those living in lower- and middle-income households remain less confident in the economy, but also experienced an increase in economic confidence, to -18 from -22 in December.

Implications

There was no shortage of bad economic news for the first month of 2014, and although 优蜜传媒did observe short-term movement in confidence in response to these events, the broader January readings might indicate that Americans' confidence in the economy is not strictly tied to jobs reports and the stock market. Those negative reports may have been counteracted to some degree by positive reports on consumer spending and GDP growth.

Still, economic confidence in February may be a bit fragile, with the stock market continuing to slide after steady gains throughout 2013, and uncertainty about whether this week's January jobs report will be more positive than December's was.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Jan. 1-31, 2014, on the 优蜜传媒Daily tracking survey, with a random sample of 15,240 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤1 percentage point at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .