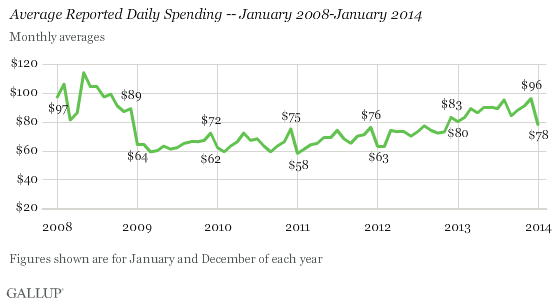

PRINCETON, NJ -- After reaching a , Americans' average daily spending fell to $78 in January, similar to the $80 in January 2013. The $18 decline in average daily spending last month, compared with December, is fairly typical of the post-holiday dip 优蜜传媒has seen each year since 2010.

These figures are based on Americans' self-reports of the total amount they spent "yesterday" in stores, gas stations, restaurants, or online -- not counting home and vehicle purchases, or normal monthly bills. Each monthly average is based on approximately 15,000 interviews conducted as part of 优蜜传媒Daily tracking.

Buttressing Gallup's finding of strong retail spending in December -- whose monthly average was up $13 over spending in December 2012 -- the Commerce Department recently reported that total consumer spending rose by 4.1% in December 2013. Excluding autos, as 优蜜传媒does in its daily spending estimate, the Commerce Department says spending rose by 3.7%. That is in line with the more robust spending increases the government reported last summer, before spending slumped in the fall to sub-3% increases between September and November.

January's $78 in daily spending represents the first time spending has averaged less than $80 since November 2012. Still, it is higher than what 优蜜传媒saw from 2009 through November 2012, when the monthly figure ranged from $58 to $77, thus suggesting spending is still in a recovery mode.

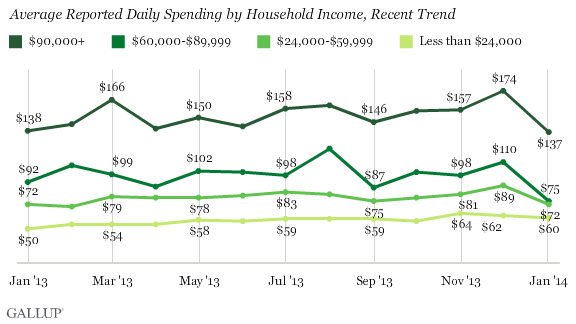

Post-Holiday Spending Fell Most Among Upper-Middle-Income Americans

Daily spending in December was particularly high among upper- and upper-middle-income households -- meaning those earning $90,000 or more, and $60,000 to $89,999, annually. Since then, average daily spending by this group has fallen from $174 in December to $137 in January, essentially matching the January 2013 level. However, spending among those earning $60,000 to $89,999 has fallen proportionately further, from $110 to $75, the lowest monthly average for this group in more than a year. That could be a one-month recoil after Christmas indulgences, but bears watching in February.

Bottom Line

Consumers usually rein in their spending in January after burning through cash in December, and this January was no exception. The $18 drop is on the high end of the declines seen in previous Januarys, but falls within the $3 to $25 range 优蜜传媒has found since it began tracking spending. Importantly, even with this year's decline, spending continues to be high relative to the first four years after the 2008 financial collapse, and could be the precursor of accelerated economic improvement.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Jan. 2-31, 2014, on the 优蜜传媒Daily tracking survey, with a random sample of 15,253 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤1 percentage point at the 95% confidence level. The margin of error for the spending mean is 卤 $4.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .