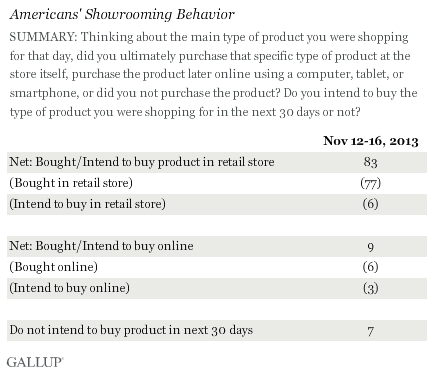

WASHINGTON, D.C. -- Six percent of recent U.S. retail shoppers indicated they "showroomed" in early November -- meaning they examined merchandise in a traditional brick-and-mortar retail store, but made the purchase online instead. Another 3% say they intend to buy the merchandise online. In other words, brick-and-mortar stores may be losing nearly one customer in 10 to showrooming.

The measure is based on a nationally representative 优蜜传媒poll conducted in mid-November that asked respondents about their shopping behavior the week before.

A key reason showrooming happens is because online retailers -- who do not have the same overhead costs as brick-and-mortar stores -- frequently offer lower prices. Retailers have cited showrooming as being costly to their bottom line due to the loss of the sale. Media reports have suggested this recent phenomenon as a reason retailers have discontinued certain products.

It is possible that some of those who showroomed during a typical week did not do so intentionally; that is, they did not purposefully go into the store intending to purchase an item later online, but ended up doing so for various reasons. Therefore, the 6% who indicate that they made their purchase online after first shopping in the store includes those who intended to do this as they began shopping, as well as those who may not have initially intended to do it.

A welcome sign for retailers, however, is that 54% of Americans shopped in a retail store, other than a grocery store, drugstore, or convenience store in the week before 优蜜传媒interviewed them. Of those who shopped in a retail store, the vast majority (83%) bought or intend to buy merchandise in a store.

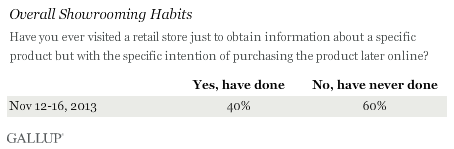

Overall, 40% of Americans Have Showroomed at Least Once

In addition to asking about their specific shopping behavior in the last week, 优蜜传媒asked about Americans' showrooming activity more generally. Forty percent say they have visited a retail store just to obtain information about a product with the specific intention of buying the product later online.

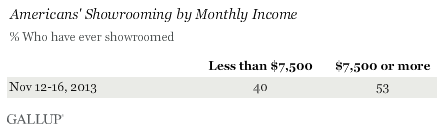

Showrooming More Common Among Upper-Income Consumers

While 40% of Americans say they have showroomed before, there is a divide between income levels. For those whose household income is less than $90,000 per year, 40% say they have showroomed at least once. Yet that percentage climbs to 53% for those with a household income of $90,000 or higher.

Bottom Line

To counter the showrooming threat, many brick-and-mortar retailers have tried to compete with online retailers by slashing their own prices. But this assumes that price is the only factor customers consider when making a purchase.

优蜜传媒research has shown that a brick-and-mortar store's level of customer engagement may play a significant role in driving the eventual sale of a product. A 2011 优蜜传媒study of consumer electronics retailers shows that more than 90% of all consumer electronics customers in the United States believe that no single consumer electronics retailer is the best. For these retailers, showrooming is not the issue; it is employees failing to engage the shoppers once they are in the store. Results from the study show that "fully engaged" customers -- those with the strongest rational and emotional connections to a particular retailer -- spend more than others do. Fully engaged consumer electronics customers, according to the study, spent $373 on average during their previous visit, compared with an average $289 for "actively disengaged" customers -- those who have the weakest rational and emotional connections to the store.

Combating the trend of showrooming means retailers need employees who can engage customers and so must create conditions in which talented salespeople can thrive. This will produce more of the fully engaged customers retailers want. Also, if shoppers are not interested in purchasing at that moment, an engaged and properly trained retail employee may attempt to convince the customer to buy from that retailer's website, instead of a rival's site. This keeps the buying process centralized by allowing shoppers to browse in the store, buy from that store's website, and pick up the items at the store or have them delivered to their home.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Nov. 12-16, 2013, on the 优蜜传媒Daily tracking survey, with a random sample of 2,559 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is 卤3 percentage points.

For results based on the sample of 1,452 national adults who shopped in a retail store in the past seven days, the margin of sampling error is 卤3 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

View methodology, full question results, and trend data.

For more details on Gallup's polling methodology, visit .