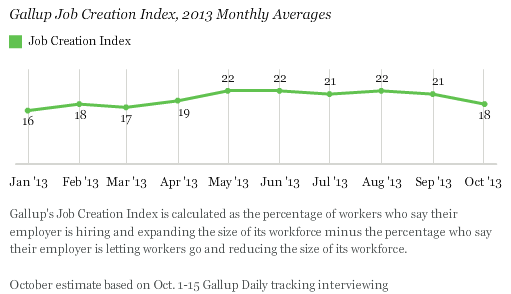

PRINCETON, NJ -- Prior to Wednesday's agreement to end the federal shutdown, an average of 35% of U.S. workers in October said their employer was hiring workers and expanding the size of its workforce, compared with 17% who said their employer was letting workers go and reducing the size of its workforce. The resulting +18 优蜜传媒Job Creation Index score is down three points from September.

The data are based on 优蜜传媒Daily tracking interviewing with more than 9,000 U.S. workers conducted Oct. 1-15. That includes a slightly more negative +17 Job Creation Index score for the week of Oct. 7-13, the worst weekly average 优蜜传媒has measured since March, shortly after the federal budget sequester went into effect.

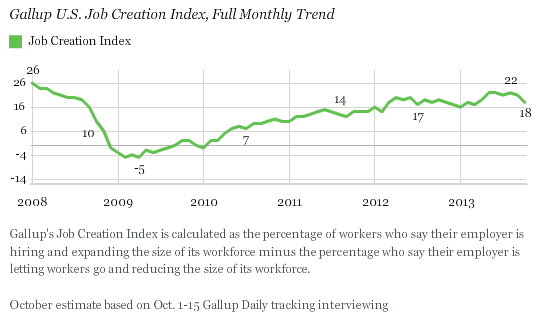

The decline in Gallup's Job Creation Index comes after workers gave more positive and generally stable reports of hiring activity from May through September, with the index averaging +21 or +22 in each of those months. Those were the most positive monthly measures since before the 2008 financial crisis.

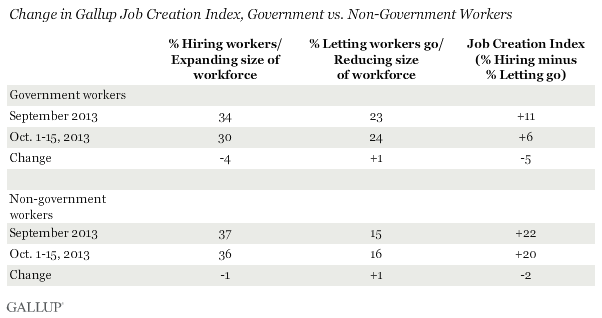

Government workers, who presumably would be most directly affected by the shutdown, reported a much more negative hiring situation in early October compared with September. Among all government workers, 30% report their employer is hiring and 24% say theirs is letting workers go, for a +6 index score. , the score among government workers was +11.

But the hiring situation is also a bit worse among the much larger group of non-government workers. For this group, the Job Creation Index in October to date is +20, compared with +22 last month.

Preliminary data indicate that government workers at all levels -- federal, state, and local -- were reporting a less positive hiring situation at their workplaces in early October than in September, so the effects of the shutdown were not confined to federal workers. 优蜜传媒will provide job creation scores for federal, state, and local government workers in its full October report, to be released early next month.

Implications

The shutdown clearly affected Americans' , and made them less optimistic about their . But one unfortunate though real economic effect of the shutdown was a likely damper on hiring activity, which prior to the government's suspending non-essential services had been the most positive since the recession ended. Both government and non-government workers reported a less positive hiring situation during the shutdown than before it began.

Now that Congress has reached an agreement to end the shutdown, at least for the next several months, the question is how quickly the effects the shutdown had on Americans' economic attitudes and behavior will dissipate.

By comparison, Gallup's Job Creation Index suffered during the 2011 negotiations to increase the federal debt limit, dropping from +15 in June to +12 in September. But it regained most of those losses quickly, with the index back up to +14 by October.

It took longer, , for economic confidence to recover at that time. If the current situation follows a similar timeline, Americans' economic attitudes may not improve before Congress must act to avoid another government shutdown, unless Congress can find a more permanent solution to its disagreements over the federal budget.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Oct. 1-15, 2013, on the 优蜜传媒Daily tracking survey, with a random sample of 9,163 working adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of workers, one can say with 95% confidence that the margin of sampling error is ±1 percentage point.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .