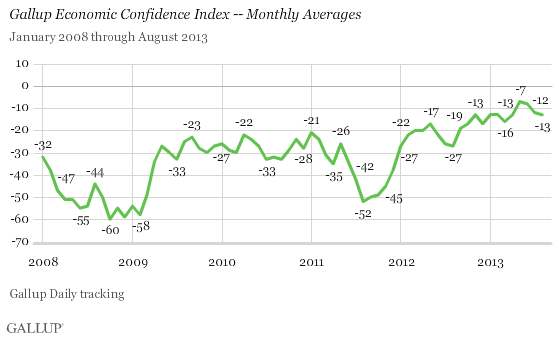

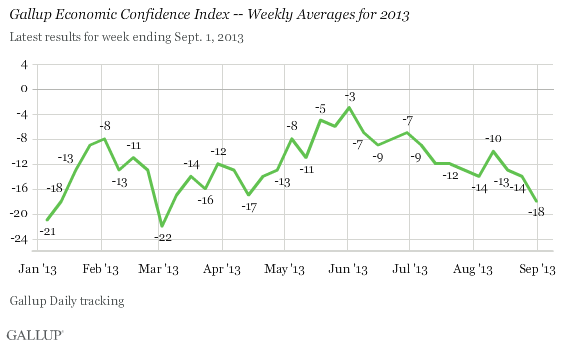

WASHINGTON, D.C. -- Americans remained more negative than positive last month about economic conditions in the U.S. The 优蜜传媒Economic Confidence Index averaged -13 in August, similar to the -12 in July. The current score is down from -7 , which was the highest monthly reading since 优蜜传媒began tracking economic confidence daily in 2008.

The results for August are based on 优蜜传媒Daily tracking interviews, conducted by landline and cellphone, with more than 15,000 Americans.

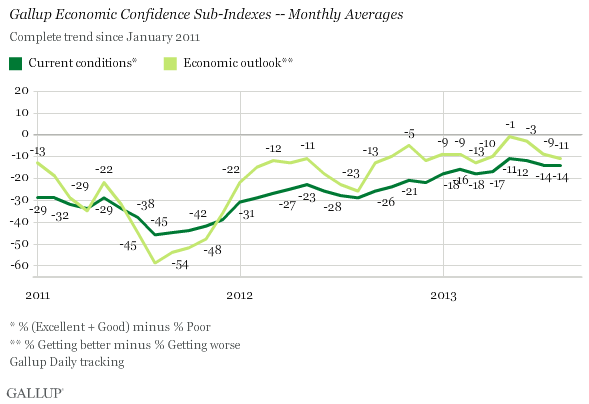

Gallup's Economic Confidence Index is based on two components: Americans' assessments of current economic conditions in the United States and their perceptions of whether the economy is getting better or worse. Americans' net current conditions score was unchanged last month, at -14, and their net economic outlook score of -11 was down slightly from -9 in July.

The six-point decline in the overall index during the past four months is almost entirely due to the deterioration of Americans' economic outlook, rather than their evaluation of current economic conditions. Americans' outlook rating has fallen 10 points since May, while the current conditions rating has slipped three points.

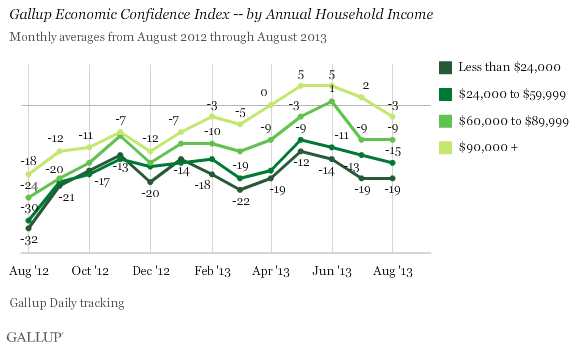

Upper-Income Americans' Confidence Slips Back Into Negative Territory

Upper-income Americans' confidence slipped into negative territory after being positive for three consecutive months. This group's confidence fell five points in August to -3, the largest drop among income groups.

Middle- and lower- income Americans' confidence is still in negative territory. Americans earning $60,000 to $89,999 annually were briefly more positive than negative about the economy in June, for the first time since 优蜜传媒began tracking confidence in 2008, but their confidence is now back in the negative zone.

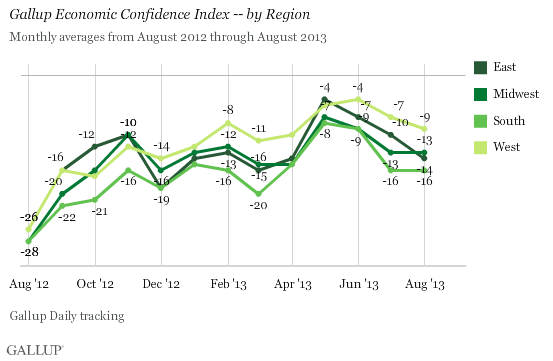

Economic Confidence Highest in the West, Lowest in the South

Americans living in the West are the most confident in the economy, at -9, while those living in the South are the least confident, at -16. Over the past year, confidence has increased at least 12 points in each region. In the near term, however, confidence has slipped in each region since May's high point in the overall index.

Economic Confidence Slides in Last Week of August

Although the August monthly average was on par with July's, confidence has been on a downward trajectory over the past three weeks. Weekly U.S. economic confidence fell four points to -18 in the week ending Sept. 1, the lowest score since late February and early March, when .

Implications

Americans are less positive about the economy than they were earlier this year, with their ratings of the economy's outlook worsening more than their ratings of current conditions. Upper-income Americans' confidence has fallen back into negative territory, which could negatively affect future consumer spending. In the short term, confidence fell during the last week in August to its lowest weekly average since March.

There are reasons to believe that Americans' confidence may not improve in the coming weeks. First, rising mortgage rates and U.S. stock market volatility may continue as the Federal Reserve considers tapering its bond-buying program. Additionally, military action in Syria could weaken Americans' economic outlook. Finally, the potential for partisan gridlock in Washington over the federal budget and raising the debt ceiling by mid-October could shake consumer confidence.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

Results for this 优蜜传媒poll are based on telephone interviews conducted Aug. 1-31, 2013, on the 优蜜传媒Daily tracking survey, with a random sample of 15,728 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is 卤1 percentage point.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline and cell telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .