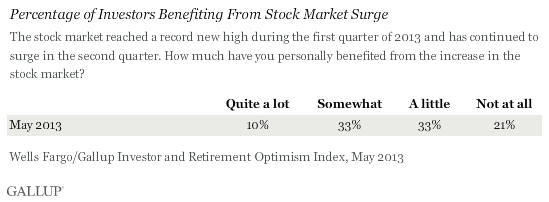

PRINCETON, NJ -- Average U.S. investors are more likely to feel they personally didn't benefit much from the record highs the stock market has recently reached, with 54% saying they benefited "a little" or "not at all," while 43% believe they benefited "somewhat" or "quite a lot," according to the Wells Fargo/优蜜传媒Investor and Retirement Optimism Index survey.

The survey, conducted quarterly, is a broad measure of the perceptions of average investors -- those having $10,000 or more in investable assets -- and tends to be a precursor of economic activity. The May 16-27 survey included a random sample of 1,426 investors.

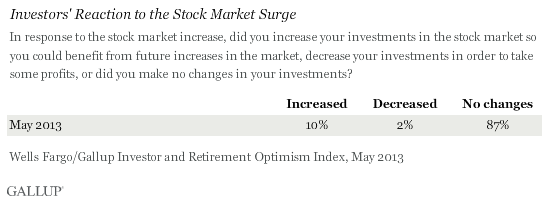

Most average investors -- 87% -- have not changed their investments to take advantage of the increasing markets, and the same was the case in March (85%). One in 10 investors said they increased their investments, while 2% decreased their holdings.

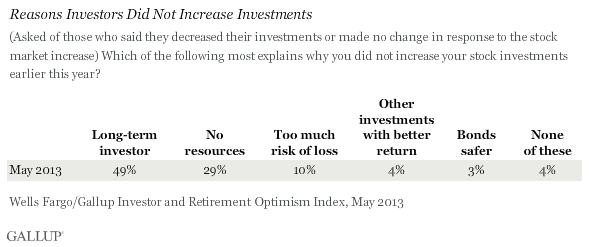

Eighty-three percent of those who did not increase their investments do not regret their inaction. When asked why they did not increase their investments, 49% noted that they are long-term investors and don't change their portfolios often, 29% say they didn't have additional resources available, and 10% offered that there was too much risk.

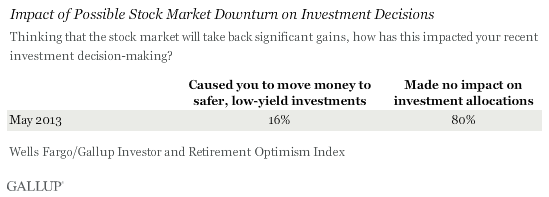

In late May, as the markets peaked, 62% of average investors accurately anticipated a correction later this year that would take back significant gains. Still, 80% of those anticipating the correction made no adjustments to their investment allocations, while 16% in this group moved into what they perceived were safer investments.

Investors See Stocks/Mutual Funds and Real Estate as Best Investments

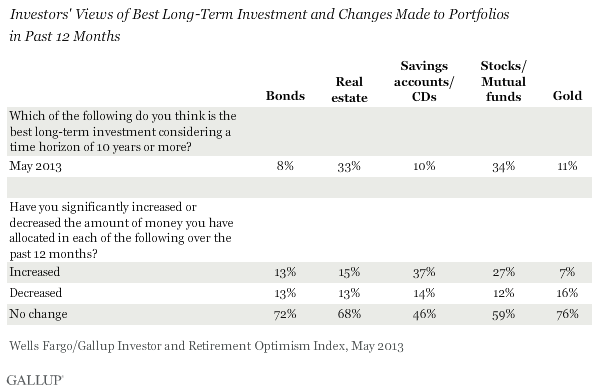

When asked to choose among five different general categories of investments as the best place to invest over the next 10+ years, 34% of average investors pointed to stocks and mutual funds, while a similar 33% indicated real estate. Far fewer chose gold (11%), savings accounts (10%), or bonds (8%).

Over the past 12 months, investors are most likely to have increased their holding of savings accounts/CDs, at 37%, while 14% have decreased them. Separately, 27% have significantly increased their investments in stocks and mutual funds. Just about as many investors increased their holdings in real estate and bonds as decreased them. And another 7% significantly increased their investments in gold and 16% decreased them.

Implications

During the last half of May, the stock market reached new highs, while investor optimism was , as was overall . However, the majority of average investors feel as though they did not benefit significantly from these market gains.

Although they failed to benefit, the overwhelming majority (83%) do not regret their investment decisions, with half saying they are not adjusting their portfolios because they are long-term investors. Even investors anticipating a significant market correction did not try to shift into safer investments as a result.

Still, it looks like the Fed efforts to pour money into the economy have been successful in getting many investors to view traditionally more risky investments like stocks and real estate as their best investments over the next 10 years. Of course, given recent market developments, gold and bonds have also turned out to be risky.

Average investors are likely suffering from the recent losses in all investment categories -- including real estate, as interest rates increase at a surprisingly fast pace. It is noteworthy in this regard that some investors significantly increased their holdings of savings accounts/CDs over the past 12 months. By doing so, they made the decision to give up yield, but preserve their capital during market downturns. Recent events suggest that, for at least some part of their balanced portfolios, this was probably wise for average investors -- particularly older investors.

Survey Methods

The Wells Fargo/优蜜传媒Investor and Retirement Optimism Index results are based on questions asked on the 优蜜传媒Daily tracking survey of a random sample of 1,426 U.S. adults having investable assets of $10,000 or more May 16-27, 2013.

For results based on the entire sample of national adults, one can say with 95% confidence that the maximum margin of sampling error is 卤3 percentage points.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .