Key Findings

-

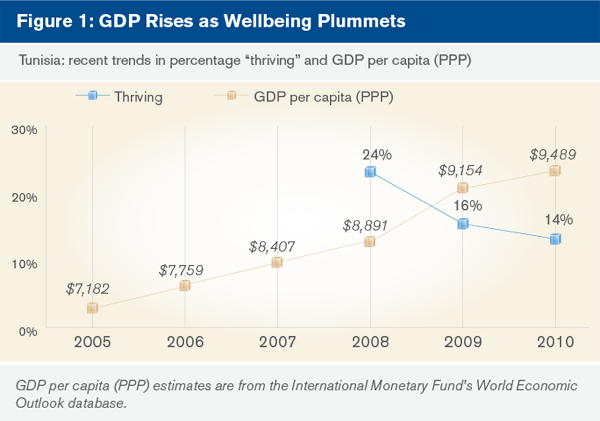

As Tunisia's GDP continued to show healthy growth in recent years, Tunisians' life evaluations continued to plummet.

-

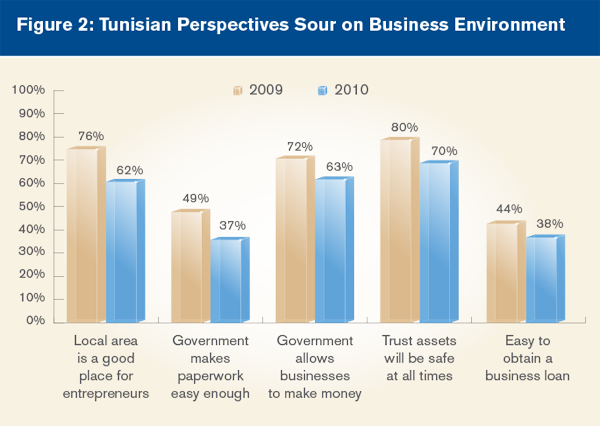

While Mohamed Bouazizi's protest over the confiscation of his vegetable cart sparked the "Arab Spring," Tunisians' perception of entrepreneurship as a viable option for employment soured.

-

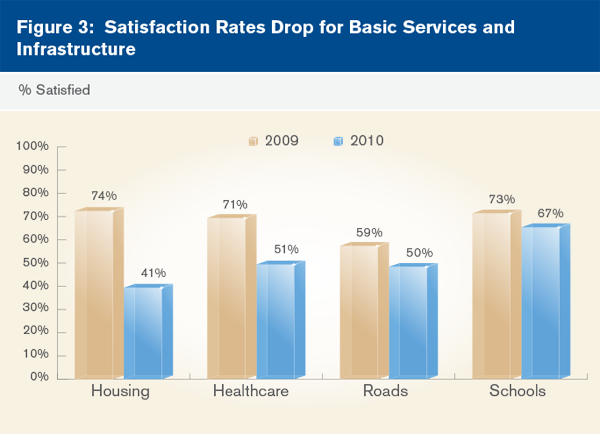

In Zine El Abidine Ben Ali's last year of rule, Tunisians' satisfaction with basic infrastructure, the cost of living, and basic services dropped noticeably.

Tunisians' Perceptions Spark the "Arab Spring"

Despite Tunisians' sharp increase in positive assessments of their national economy between 2009 and 2010, their perceptions in 2010 worsened on a variety of key variables. Tunisians' perceptions soured on well-being/life evaluation, employment, satisfaction with basic infrastructure, and the perception that businesses can succeed without heavy government interference or control. Recent events in Tunisia and Egypt have also highlighted the shortcomings of development approaches and impact assessments that rely solely on classical economic measures. While monitoring GDP growth and other classical measures are important, recent events highlight the equal importance of tracking perceptions based on behavioral economics, particularly within countries with authoritarian forms of governance.

The current situation in Tunisia offers international development partners, within the region and beyond, an opportunity to bolster the role of citizens, indigenous civil society organizations, and businesses working to harness the talents and skills of job seekers within their country. The regional focus on the events in Tunisia offers international partners an opportunity to invest in projects and businesses working to address some of the development challenges that initially sparked the popular uprising in the country. Playing a successful role in collaborating to rebuild Tunisia's economy and infrastructure will also help such partners bolster their brand in a changing region. They can do this by providing potential opportunities for partnership in other countries in the region, such as Egypt, which is also experiencing a transitional period.

In an effort to examine public perceptions on economic and social challenges facing citizens throughout the Middle East and North Africa (MENA) region, and as part of Gallup's continuous global tracking and worldwide research, 优蜜传媒regularly conducts a series of public opinion polls in 19 countries and areas in the MENA region.[1] The following is an assessment of Tunisians' perceptions on a variety of topics related to recent developments in the country. This analysis focuses particularly on changes in perceptions from 2009 to 2010[2] and, where relevant, compares these with the median of all middle-income countries3[3] in the region in 2010.

The Deceiving Lens of Classical Economic Measures

The recent uprising in Tunisia, leading to the end of Ben Ali's rule, took most analysts in the West, as well as throughout the region, by surprise. This is primarily because of various positive reviews based on classical measures of the country's economic performance and vibrancy in recent years. For example, Tunisia gained eight points in the World Economic Forum's Global Competitiveness Index, from 40 in 2009-2010 to 32 in 2010-2011. Furthermore, Tunisia was the only North African country that did not experience a decline in its rankings in the Competitiveness Index during this same period.

Despite such growth, Tunisians rated their lives noticeably worse at the same time that international finance and economic organizations hailed the country's GDP gains and economic reforms.

Over the past three years, fewer Tunisians were "thriving," despite the fact that such rates often correlate strongly with GDP gains. Such trends were also similar in Egypt, the largest country in North Africa.

优蜜传媒classifies respondents' well-being as "thriving," "struggling," or "suffering," according to how they rate their current and future lives on a ladder scale with steps numbered from 0 to 10 based on the Cantril Self-Anchoring Striving Scale. People are considered thriving if they rate their current lives a 7 or higher and their lives in five years an 8 or higher.

Tunisia is also unique in that it has maintained a vibrant middle class through the early years of the 21st century. Meanwhile, neighboring countries such as Algeria and Morocco as well as Egypt have seen the gap between rich and poor increase dramatically. However, like its North African neighbors, Tunisia struggled with government corruption. This was particularly the case with regard to regulation of the private sector, as corruption often falls off the radar of classical economic measures such as GDP growth.

In this same vein, a major factor putting recent events in Tunisia into context was the perception among the general public that Tunisians did not benefit from their country's economic success. Additionally, the data highlight a sense that ordinary citizens were running out of options, such as starting their own entrepreneurial endeavors, when it came to unemployment challenges. 优蜜传媒data underscore how Tunisians' worsening perceptions and increasing frustration with such domestic challenges increased noticeably from 2009 to 2010.

Vanishing Prospects for Employment

In both 2009 and 2010, a majority of Tunisians (56%) said that the national economy in their country was improving overall. On face value, this positive perception was much higher than the middle-income country median of 31% in 2010. This may seem puzzling in light of recent developments in the country, sparked in large part by Tunisians' attitudes regarding economic opportunities and corruption within Ben Ali's regime. However, when examining the degree to which Tunisians perceived themselves as personally benefiting from improved economic conditions, recent events fall into context.

Despite Tunisians' noticeably positive assessments of the trajectory of their national economy, their perceptions in 2010 worsened on a variety of closely related variables. These included various measures of satisfaction with basic infrastructure, services, and the perceptions that the government will allow businesses to make a lot of money and that it makes paperwork and permits easy enough for entrepreneurs.

It is no surprise that government corruption, particularly in the business setting, also may have played a major role in fostering discontent with the Ben Ali regime. However, exposing such corruption during Ben Ali's rule may have been a risky undertaking. When 优蜜传媒asked young Tunisians about whether the government was doing enough to fight corruption, response rates of approval were so high that the data were deemed invalid and thus suppressed. The tipping point for Tunisia's unrest was the self-immolation of a 26-year-old Tunisian man who had been harassed and whose goods had been confiscated by a municipal inspector. The data highlight that Bouazizi's frustration was not unique among citizens across the country. In 2009, when asked whether the government makes paperwork and permits easy enough for entrepreneurs, 49% of Tunisians said yes. This number dropped significantly the following year to 37%.

The perception of entrepreneurship, or starting one's own business, as an alternative to prolonged unemployment was also an important factor highlighting Bouazizi's predicament as a symbol for what many in the country were experiencing. In 2010, about two-thirds of Tunisians (63%) said they would consider starting their own business if unemployed for six months or longer. This is down from 80% in 2009, indicating Tunisians grew less confident in entrepreneurship as a feasible alternative to traditional employment opportunities. This change was likely based on an assessment that due to structural and bureaucratic challenges, starting one's own business was not feasible or profitable enough an endeavor to sustain one's needs. In 2010, 59% of Tunisians said that if unemployed for six months or longer, they would be willing to retrain in a different career field.

Furthermore, perceptions that entrepreneurs can trust the government to allow their business to make a lot of money also declined in 2010. In 2009, 72% of Tunisians said so. In 2010, this percentage dropped to 63%. The average for this measure among middle-income countries was 50% in 2010. Tunisians' perceptions of the safety of business assets in their country also dipped; in 2010, the proportion of those who said entrepreneurs can trust their assets and property to be safe at all times dropped to 70% from 80% in 2009. Additionally, assessments of whether one's city or local area is a good place for entrepreneurs looking to start their own businesses also significantly declined from 76% in 2009 to 62% in 2010.

Satisfaction With Basic Needs and Infrastructure Worsen

The availability of affordable housing in Tunisia is important for two reasons. First, like many countries throughout the MENA region, Tunisia is experiencing a demographic youth bulge. This type of shift in the proportion of citizens under the age of 30 places additional stress on a state's ability to meet the basic needs of citizens in this stage of life. This growing young population places high demands on educational institutions, public transportation, and the economic requirements needed for a citizen to transition from adolescence to adulthood (employment, independent living/marriage). As evident from recent events across the region, a government's inability to cope with such demands often engenders a great deal of resentment toward and disappointment with the state and other agents of authority. This extends what is often called in the Arab world the "waithood" period, during which youth, particularly young men, have to wait several years to find employment after they complete their education or training in a particular field. Employment is the crucial first step in enabling young people to begin saving money to cover the expenses of marriage. Housing costs are usually the major expense associated with marriage in North African societies.

Second, as a result of the moderate and stable GDP growth during the previous years in Tunisia, the cost of living, including the cost of housing, began to rise. This rise in costs exacerbates the challenge for young people looking to start their lives as independent adults. An increase in the cost of living also places similar pressures on older citizens struggling to maintain their families' existing standard of living.

Thus, when 优蜜传媒asked Tunisians in 2010 whether they were satisfied with the availability of affordable housing, 41% said yes - a sharp decline from 2009 when 74% shared this view. In addition to housing, Tunisians' satisfaction with other public infrastructure, such as public transportation systems, also experienced a notable decline from 2009 (74%) to 2010 (55%). Tunisians were also less likely in 2010 (50%) than in 2009 (59%) to express satisfaction with the quality of the roads and highways they use.

It is important to note that Tunisia, with a relatively well-educated population when compared to neighboring countries, also experienced a drop in satisfaction with local schools and educational institutions in 2010 (67%) when compared with 2009 (73%). Tunisians grew more negative about other basic services, such as satisfaction with the availability of quality healthcare in Ben Ali's last year of rule. In 2010, about one-half (51%) of Tunisians expressed satisfaction with the healthcare to which they had access - a drop from the previous year (71%).

Implications and Recommendations

Gallup's findings highlight a growing sense of frustration among Tunisians with the challenges they face in reaping the benefits of a country hailed as an example of quick social progress and economic growth in North Africa. After the overthrow of Ben Ali, the entire region, governments and citizens alike, are now closely monitoring what is to come in this small country. Regional actors are also closely following the reaction of international partners such as the United Nations Development Program, the U.S. Agency for International Development (USAID) and European Union entities with a track record in investment and development initiatives in North Africa, such as the EU Investment Bank.

Recommendations for International and Regional Development Partners

As the political situation stabilizes within the country, the international development and investment communities should seize this rare opportunity of political opening in North Africa and bolster their roles and programs in Tunisia. Western organizations and government agencies, such as USAID, now have a strategic interest in rectifying their tarnished image resulting from their cooperation with the Ben Ali government. Declining satisfaction with basic infrastructure as well as the change in government offer such institutions a chance to build good will with Tunisians as well as with citizens across the region.

For International Development and Trade Partners

Those who wish to invest in Tunisia's development into a stable, economically successful democracy should:

路 Invest in improving basic infrastructure, health services, and affordable housing. These opportunities present apolitical means by which such partners can invest in Tunisia's economic development in a manner that touches the lives of average Tunisians.

路 Invest in traditional media infrastructure (radio and television), Internet connectivity, as well as other forms of fiber optic communication. In a now more open and free media environment, traditional and new media technology and infrastructure are all areas where state control and censorship had previously overregulated and politicized investments. It is in these fields where for-profit investors can mobilize their resources, not as a form of aid, but as opportunities for potentially lucrative business investments.

International partners, particularly in Europe and the U.S., now have an opportunity to bolster their credibility as partners of the people and not the protectors of regimes perceived to be autocratic and corrupt in the eyes of their citizens.

For Regional Development and Trade Partners

Development agencies and private-sector companies within wealthier Gulf Cooperation Council (GCC) countries can also now play a pivotal role in the development of Tunisia's economic outlook. As many Gulf countries such as Kuwait, Saudi Arabia, Qatar, and the United Arab Emirates have demonstrated a commitment to helping Egypt's economy regain its footing, Tunisia also offers another opportunity for intra-regional cooperation, business, and development.

With nearly one-quarter of Tunisia's labor force engaged in agriculture, GCC countries with food resource challenges should also look to bolster produce trade with Tunisia as a sustainable investment in the country's transition to democracy.

For International Finance and Economic Policy Organizations

These organizations should invest in more accurate, perception-driven tools to measure impact.

A crucial component that led to the unpredictability of the Tunisian revolution was a silo-like focus on assessing the economic and social health of developing countries through classical economic measures alone. While monitoring GDP trends is important, international organizations such as the World Bank and others must now invest in more accurate, perception-driven tools to assess impact. Behavioral and attitudinal data, collected at the individual level, are the best measures of the effect of policies, programs, and initiatives. It is through these metrics that global and international organizations test to what degree policy shifts at the macroeconomic level benefit citizens at the local and microeconomic level. Neglecting this approach will result in a continued loss of large sums of investment and finance funds pumped into countries whose lack of political and social stability result in major economic setbacks and dissuade future investment. With what is hoped to be a more open political environment in Tunisia, such research should be easier to conduct in a more timely, constant, and cost-effective manner.

Without these kinds of performance indicators, countries may continue to grow on a variety of macroeconomic country-wide measures, but still leave individual citizens feeling disenfranchised and less hopeful. Relying on behavioral and attitudinal indicators will also leave international partners better informed about the types of networks and stakeholders they must engage in-country to craft more robust and effective interventions at the local level.

Survey Methods

优蜜传媒is entirely responsible for the management, design, and control of this study. For the past 70 years, 优蜜传媒has been committed to the principle that accurately collecting and disseminating the opinions and aspirations of people around the globe is vital to understanding our world. Gallup's mission is to provide information in an objective, reliable, and scientifically grounded manner. 优蜜传媒is not associated with any political orientation, party, or advocacy group and does not accept partisan entities as clients.

Results are based on face-to-face interviews in Tunisia with approximately 1,000 adults in each survey administration, aged 15 and older, during 2009 and 2010. Surveys in 2009 were conducted February 20-March 25 and August 2-22; in 2010, they were conducted February 3-April 27 and September 10-October 25. For results based on the total sample of adults, one can say with 95% confidence that the maximum margin of sampling error is 卤2.5 percentage points. The margin of error reflects the influence of data weighting. In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

The questionnaire was translated into Arabic. The translation process starts with an English version. A translator who is proficient in the English and Arabic languages translates the survey into the target language. A second translator reviews the language version against the original version and recommends refinements.

Abu Dhabi 优蜜传媒Center

The Abu Dhabi 优蜜传媒Center is a 优蜜传媒research hub based in the capital of the United Arab Emirates. It is the product of a partnership between Gallup, the world's leading public opinion research firm, and the Crown Prince Court of Abu Dhabi.

Building on Gallup's seminal work in the field of Muslim studies, the Abu Dhabi 优蜜传媒Center (ADGC) offers unmatched research on the attitudes and aspirations of Muslims around the world. In addition to its worldwide scope, the ADGC focuses on the specific priorities of its regional base and presents innovative analysis and insights on the most important societal challenges facing the United Arab Emirates and the Gulf Cooperation Council (GCC).

[1] 优蜜传媒polls approximately 1,000 nationals in each country twice a year. All samples are nationally representative and are selected randomly in accordance with Gallup's World Poll methodology. All surveys take place in the respondents' home and are conducted in local languages. For more details about Gallup's World Poll methodology see: https://worldview.gallup.com/content/methodology.aspx

[2] The data displayed for each year are an aggregation of two separate waves of polling. In 2009, 优蜜传媒conducted polls in Tunisia February 20-March 25 and August 2-22. In 2010, 优蜜传媒conducted polls in Tunisia February 3-April 27 and September 10-October 25.

[3] The middle-income country group includes: Algeria, Egypt, Iraq, Jordan, Lebanon, Libya, Morocco, Syria, and Tunisia. 优蜜传媒grouped countries into categories according to 2010 estimates of GDP per capita (in U.S. dollars) provided by the International Monetary Fund. Countries fall under one of three income categories: high income (GDP per capita of at least $23,000), middle income (GDP per capita ranges from $2,600 to less than $23,000), and low income (GDP per capita of less than $2,600).