PRINCETON, NJ -- Gallup's Job Creation Index reached a post-recession high of +13 in April. This does not differ much from the +12 of the prior two months, but well exceeds the +5 of April 2010.

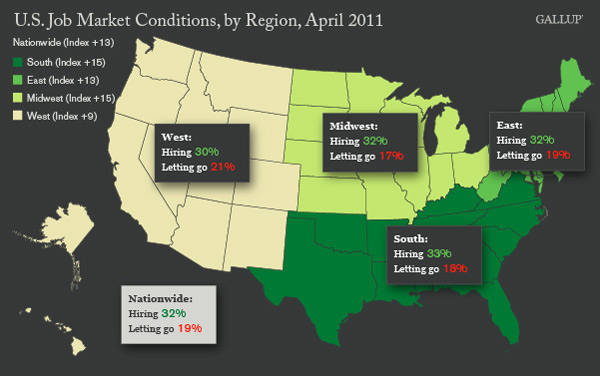

April's +13 index score is based on 32% of workers nationwide saying their employers are hiring and 19% saying their employers are letting workers go. The February and March readings were 30% hiring and 18% firing. The April index shows improvement over April 2010, when 27% of workers said their companies were hiring and 22% said they were letting workers go.

Job Market Conditions Improved in South and Midwest

Job market conditions were best in the Midwest and the South, at +15 each, but worst in the West, at +9. The year-over-year job situation improved the most in the Midwest and East, while showing the least improvement in the South.

Implications

The long-suffering job markets in the Midwest appear to be benefiting from continuing improvements in the manufacturing sector, and one of the benefits of the weak U.S. dollar has been to make U.S. exports more attractive globally. As a result, this region has the lowest firing in the nation and, along with the East, shows the most year-over-year improvement.

Still, increased manufacturing activity has been enough to stimulate only a modest improvement in job growth nationwide. Although technically hitting a new high in April, Gallup's Job Creation Index suggests there has been a virtual stagnation of job market conditions over the past three months. This stagnation most likely reflects the slower economic growth of the first quarter that seems to have continued in April.

At the same time, the finding that job growth in April was consistent with that of February and March is not bad, given the current economic headwinds of surging food and gas prices.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , ,

Weekly: , , ,

about Gallup's economic measures.

our economic release schedule.

Survey Methods

For 优蜜传媒Daily tracking, 优蜜传媒interviews approximately 1,000 national adults, aged 18 and older, each day. The 优蜜传媒Job Creation Index results are based on a random sample of approximately 500 current full- and part-time employees each day.

National results for April are based on 优蜜传媒Daily tracking interviews with 16,833 employees conducted April 1-30, 2011. For this sample, one can say with 95% confidence that the maximum margin of sampling error is 卤1 percentage point. Regional results for March are based on interviews totaling more than 3,000 in each region. For each total regional sample, the maximum margin of sampling error is 卤3 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample includes a minimum quota of 400 cell phone respondents and 600 landline respondents per 1,000 national adults, with additional minimum quotas among landline respondents for gender within region. Landline telephone numbers are chosen at random among listed telephone numbers. Cell phone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted by gender, age, race, Hispanic ethnicity, education, region, adults in the household, and phone status (cell phone only/landline only/both, cell phone mostly, and having an unlisted landline number). Demographic weighting targets are based on the March 2010 Current Population Survey figures for the aged 18 and older non-institutionalized population living in U.S. telephone households. All reported margins of sampling error include the computed design effects for weighting and sample design.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .