PRINCETON, NJ -- Gallup's Job Creation Index increased to +10 in October from +9 in September, indicating a slight improvement in employee hiring and firing perceptions last month.

The +10 index score for October reflects 30% of U.S. workers saying their employers are hiring and 20% saying theirs are letting workers go. From 28% to 30% of working Americans have said their companies are hiring and 20% or 21% have said their employers are letting workers go since May. In turn, this suggests that the October numbers do not reflect a significant change in job market conditions. However, job market conditions are better now than they were at this time a year ago, when the Job Creation Index was +2.

Federal Hiring Surge in October

Federal government employees report a surge in hiring during October to +17, with 39% saying their employer was adding people and 22% saying it was letting people go. State (-8) and local (-12) government employees continue to report less hiring and comparatively more employees being let go, although the local government situation appears to have improved slightly last month.

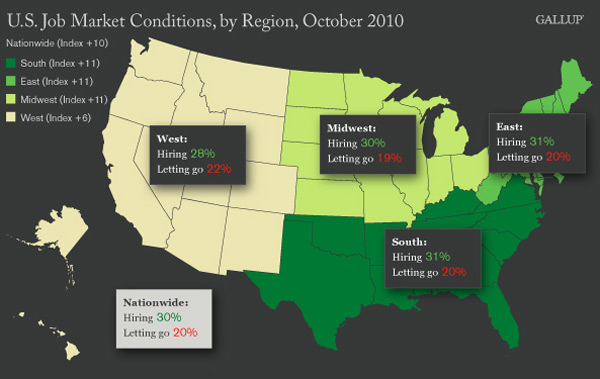

Job Market Perceptions Bounce Back in the West

Job conditions appear to be fairly similar across most of the country, with more employees in every region reporting that their companies are hiring than saying their companies are letting employees go. Job conditions remain relatively weaker in the West than in the rest of the nation -- possibly the result of the continuing struggles of the housing market in this region. Still, conditions in the West did bounce back in October to their August level of +6, a two-year high.

Commentary

Gallup's Job Creation Index is based on employees' reports about what is happening to job conditions in their companies. The index includes federal, state, and local government hiring and firing conditions, and remains consistent with jobless claims as the government reports them.

While October results show a modest improvement based on increased federal government hiring and a bounce-back in the West, 优蜜传媒modeling of these results suggests continued modest job growth that is not sufficient to keep up with normal U.S. population and workforce growth. In turn, this implies that the Federal Reserve and Congress need to consider what they might do to improve current job market conditions -- essential to creating a sustainable economic recovery.

In this regard, the Fed will be considering how it will implement its next stage of "quantitative easing" over the next couple of days. The question is whether such an effort will do as much for U.S. job creation as its announcement has already done for Wall Street wealth creation.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: , ,

Weekly: , , ,

about Gallup's economic measures.

Survey Methods

For 优蜜传媒Daily tracking, 优蜜传媒interviews approximately 1,000 national adults, aged 18 and older, each day The 优蜜传媒Job Creation Index results are based on a random sample of approximately 500 current full- and part-time employees each day.

National results for September are based on 优蜜传媒Daily tracking interviews with 16,662 employees. For this sample, one can say with 95% confidence that the maximum margin of sampling error is 卤1 percentage point. Regional results for August are based on interviews totaling more than 3,000 in each region. For each total regional sample, the maximum margin of sampling error is 卤3 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each daily sample includes a minimum quota of 150 cell phone respondents and 850 landline respondents, with additional minimum quotas among landline respondents for gender within region. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted by gender, age, race, Hispanic ethnicity, education, region, adults in the household, cell phone-only status, cell phone-mostly status, and phone lines. Demographic weighting targets are based on the March 2009 Current Population Survey figures for the aged 18 and older non-institutionalized population living in U.S. telephone households. All reported margins of sampling error include the computed design effects for weighting and sample design.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit .