This is the fourth in a four-part series on the "State of the States" being released this week on Gallup.com. The series examines state-by-state differences in party affiliation, religiosity, consumer confidence, and employer hiring and letting go, based on ÆéûÜǨû§Poll Daily tracking data collected throughout 2008.

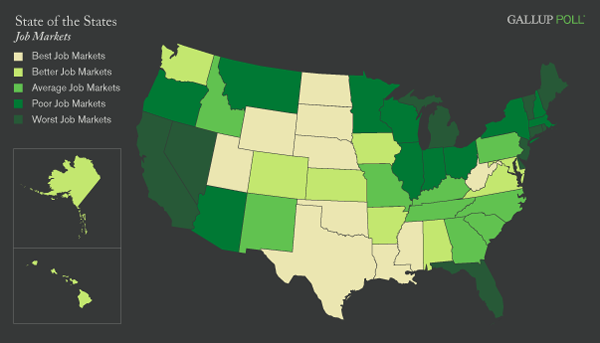

PRINCETON, NJ -- According to combined ÆéûÜǨû§Poll Daily tracking for all of 2008, oil-producing states Wyoming, Louisiana, Oklahoma, and Texas took four of the top five spots as the "best state job markets." By way of contrast, long economically depressed Michigan and housing disaster states Florida and Nevada took three of the four "worst state job market" spots.

These results are based on aggregated data from more than 100,000 interviews with employed adults in 2008. ÆéûÜǨû§asked those who were employed whether their companies were hiring workers and expanding the size of their labor forces, not changing the size of their workforces, or laying off workers and reducing the number of employees they had. The figures reported here represent the net difference between the percentage reporting an expansion and the percentage reporting a reduction in their workforces.

Over the course of 2008, nationwide and in each state, this net score was positive. However, as job losses have mounted.

In addition to South Dakota and the four oil-producing states mentioned above, other "best job market" states include oil states like North Dakota, those benefiting from coal like West Virginia, and farm states with comparatively good economies from ethanol and a strong commodities market like Nebraska. Financial-crisis states in the Northeast, including Rhode Island, Delaware, Vermont, New Jersey, Connecticut, and Maine are some of the "worst job market" states, as is the housing crash state of California.

The second quintile of "better job market" states includes those with comparatively better economies because they are also energy-related, like Alaska, and farm-related, like Kansas. Similarly, the second-worst quintile of "poor job market" states have economies damaged by the financial debacle, like New York; the manufacturing depression, like Ohio; and the housing disaster, like Arizona.

Not surprisingly, there is a great deal of overlap between state job-market conditions and . Eight of the best job-market states are in the top 10 in terms of consumer confidence and 6 of the worst job-market states are in the bottom 10 in consumer confidence. (The full data for all states appear at the end of the article.)

Bubble Economics

The state job-market results for 2008 tend to reflect the "bubble" economics of recent years. For example, the fallout from the housing-bubble collapse has cratered the job market in many states, as has the crash of the financial services bubble. For the year as a whole, the energy and commodities bubbles created some comparatively good job-market conditions, but now that those bubbles have burst, many of those states that had the best job markets in 2008 are beginning to experience bubble-bursting fallout in their job markets.

The reality is that all of the recent business-sector and geographic bubbles have produced tremendous economic uncertainty and instability. In turn, Gallup's net new hiring measure shows that these economic conditions have produced a crashing job market throughout 2008. While the net new hiring numbers were positive for 2008 as a whole, they were negative as the year came to a close, indicating that job losses continue to accelerate -- surging past the 100,000-a-week rate.

Right now, everyone seems to be counting on the Federal Reserve and the federal government to stop the bleeding. The question is whether this proposed "solution" will stimulate the real private-sector economy, increasing the demand for new employees and creating new jobs, or will simply end up creating another unsustainable government spending bubble.

Survey Methods

Results are based on telephone interviews with 112,276 employed adults, aged 18 and older, conducted in 2008 as part of ÆéûÜǨû§Poll Daily tracking. For results based on the total sample of national adults, one can say with 95% confidence that the maximum margin of sampling error is ôÝ1 percentage point.

The maximum margin of sampling error for the states ranges from ôÝ1 percentage point for large states such as California to as high as ôÝ8 percentage points for the District of Columbia.

Interviews are conducted with respondents on land-line telephones (for respondents with a land-line telephone) and cellular phones (for respondents who are cell-phone only).

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.