This post is part of Gallup's ongoing series on the shifting landscape for financial institutions. It provides insights into channel optimization, emerging customer behaviors and preferences, product penetration and relationship growth, engaging the most critical affluent and business customers, and reshaping banks' overall value proposition.

In banking, we often think about customer "transactions" as discrete opportunities to either succeed or fail with the customer. Succeed enough over the course of time, without any substantial "fails," and the customer should reward you with increased business -- or at least keep you near the top of their consideration set. The problem with this view is that it is extremely passive, and passivity kills. It assumes that these transactions are routine, rudimentary service interactions, divorced from any kind of meaningful needs discussion, and that only by succeeding at them do you earn the right to have the more meaningful conversations with customers (when the customer decides they are good and ready.) This is a losing proposition, especially in today's world where banks need to sell more products to more customers to make up for shortfalls in fee and spread income.

So, forget about transactions -- they are all conversations. A customer visiting a branch to deposit a birthday check from his great aunt? That is a conversation. A customer calling the contact center to transfer money between accounts? That is a conversation. With customers' having the ability to complete more and more transactions today through digital channels, when the opportunity presents itself to speak to a living, breathing person -- you need to seize it. And at that point, it is no longer merely a transaction (that you are still expected to execute flawlessly), it is an opportunity to engage in -- or at least start -- a meaningful, needs-based conversation.

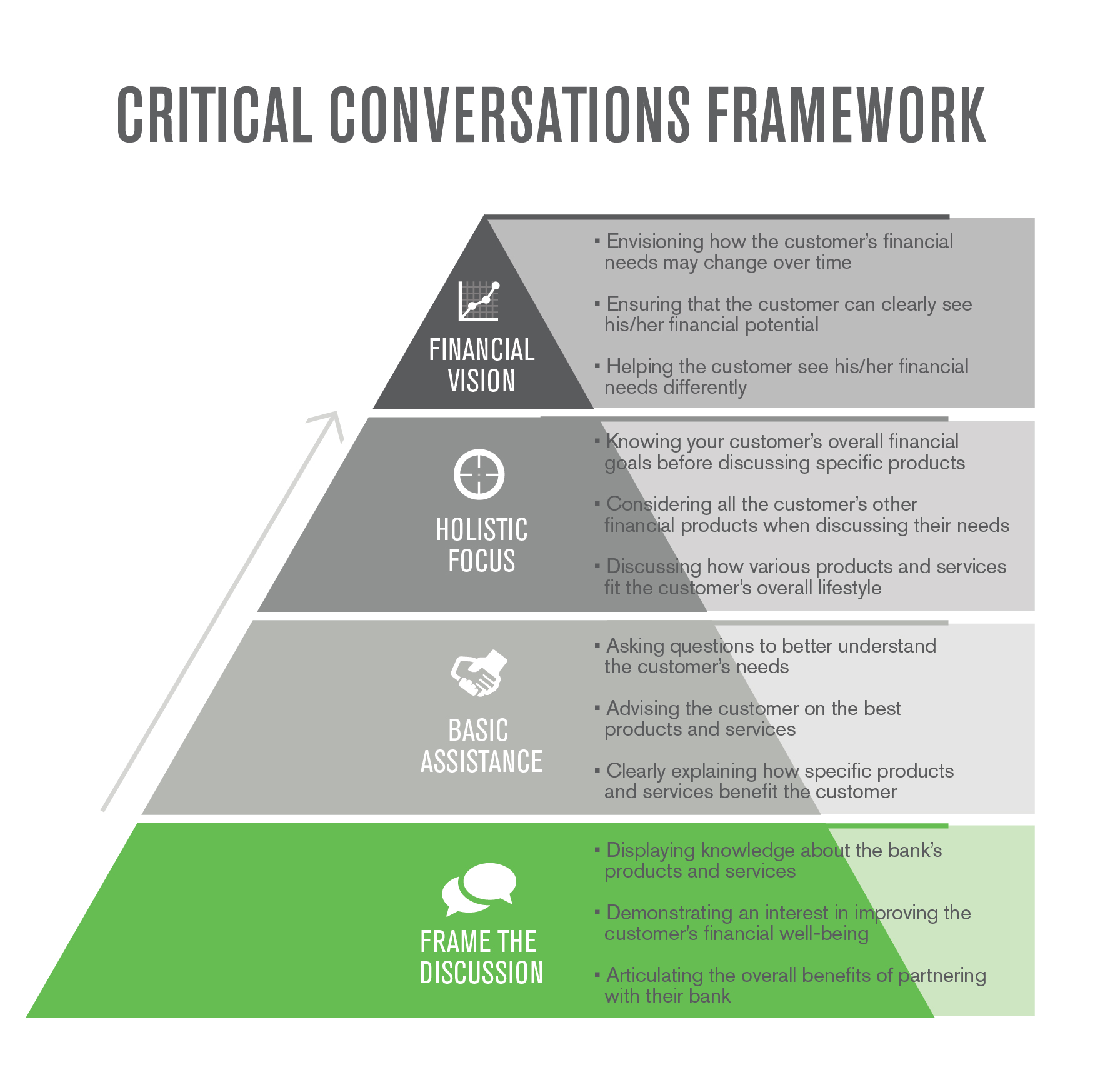

From our work with banking clients and our industry research, we have arrived at the following framework for thinking about, measuring, and managing these critical conversations (the attributes listed are representative examples of a larger set of items at each level).

Frame the Discussion: There are foundational elements of conversation that everyone, from tellers to platform associates, should exhibit every time they talk with a customer. Whether the conversation involves a routine activity or a highly complex needs-based discussion, the goal is to establish that you know what you are talking about, are acting in the customer's best interests, and are reinforcing their decision to bank with you. Executing these conversations well will not necessarily differentiate your bank, but failing to do these well will prevent you from even getting in the game.

Basic Assistance: Yes, in 2014, "basic" assistance means actually getting to know your clients and ensuring your conversations are all about them, even with your tellers and phone customer service representatives (CSRs). Let's rephrase that -- especially with your tellers and CSRs. After all, the vast majority of conversations in a branch or call center are handled by these front-line employees. And it is here that banks often fall into two categories: 1] those that get skittish about asking their tellers/CSRs to be more than just polite order-takers, and 2] those that employ the "do you want fries with that" approach and try to sell every customer the same product or service, regardless of need. If you are part of the former group and think that some of these attributes sound a little too "salesy" for tellers, then we would ask you -- do you want your tellers to generate more referrals to increase your overall sales? If your answer is "yes," then they are going to need to learn how to provide this "basic assistance" in the context of what can be a quick, routine discussion. If you are part of the latter group, trust us when we say that increasing the specificity and usefulness of offers while decreasing their frequency will lead to higher closing rates and more products sold with the added benefit of not disengaging your customers.

Holistic Focus: This is where the focus of the program shifts more toward platform employees. You have framed the discussion positively, you've settled on some potential products and services that meet the customer's immediate needs, and now it is incumbent upon you to lead the conversation in a more holistic direction. Not every conversation will, or should, take this turn. But today, there are many conversations led by many bankers that stop short of this level -- even when the client would be perfectly willing to go there. Conversations here should address bigger life goals than simply "needing" a particular product. They should also address how all of the customer's financial products and services are working (or not working) toward meeting those life goals, and they should ensure that these products and services are a good fit to their overall lifestyle. It is better to talk about benefits than product features; it is best to relate those benefits to the customer in a very personal manner, and you can't do that if you don't have engaging conversations or meaningful relationships. Even if you don't make a "sale" that day, you are closer to creating a true emotional connection and demonstrating that you are looking out for the customer's best interests.

Financial Vision: Not every conversation gets here, but at some point every relationship should. Here, the bank representative assumes the role of teacher, guide, and even mentor. You are able to help customers view their financial lives in new and different ways, envision how those lives might change over time, and ultimately help them reach their financial potential -- whatever that might be. By now, you have met all their expectations and demonstrated your genuine interest in them. If you've executed the first three levels well, you've created a level of customer engagement and trust that has earned you the right to have these very in-depth conversations. And engaged customers expect these types of conversations from their bank. According to ÆéûÜǨû§research, 66% strongly agree that their banks are "partners with me in managing my finances" and that their bank "takes the lead in helping me get where I want to be." Less than 1% of disengaged customers feel this way about their bank. You aren't going to "take the lead in helping customers get to where they want to be" by focusing on rates, terms, or conditions.

Of course, mapping out a framework like this is only part of the answer, albeit an important part. The key to transforming more transactions into conversations, and improving the quality of those conversations, occurs at the front lines with the tellers, bankers, and advisers themselves. If banks are truly interested in having more and better conversations with customers, they need to consider how they select, onboard, train, coach, support, manage, incentivize, and promote their key human capital assets to support this framework.

To learn more about how to increase customer engagement and growth, visit the area on this site.