The U.S. Council on Competitiveness asked 优蜜传媒to conduct, pro bono, a comprehensive study of U.S. growth and productivity for the Council's 30th anniversary.

We enthusiastically said yes.

A 优蜜传媒senior economist led the study. Top 优蜜传媒experts and esteemed external senior scientists reviewed it to ensure statistical and theoretical accuracy and objectivity.

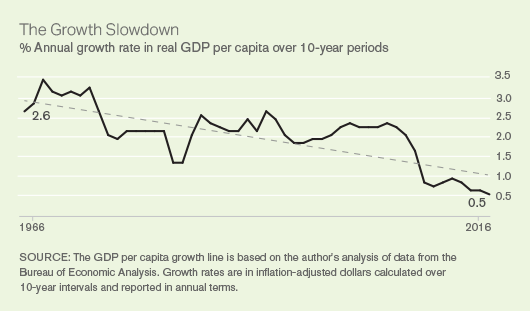

Conventional wisdom -- as reported in many major newspapers and media -- tells us the U.S. economy is "recovering." Well-meaning economists, academics and government officials use the term "recovery" when discussing the economy, implying that growth is getting stronger.

, released today, finds there is no recovery. Since 2007, U.S. GDP per capita growth has been 1%.

The Great Recession may be over, but America is dangerously running on empty.

Think of our country as a company, America Inc., which has more than 100 million full-time employees, with about $18 trillion in sales and $20 trillion of debt. The most serious problem facing it is no growth. In addition, America Inc. has three soaring expenses threatening to bankrupt the company and its shareholder-citizens: healthcare, housing and education.

As this report notes, in 1980, these three sectors accounted for 25% of total national spending -- today, they account for more than 36%. They also account for most of the total measured inflation over the same period. And without inflation in these sectors, real annual productivity -- defined as GDP per capita growth -- would have been an estimated 3.9% instead of 1.7%.

My own opinion is that America Inc. is too big to "turn around" like one would a company or any other organization. There is no quick fix to something this huge and complex. But there is a long-term fix, which is to get GDP increasing to 3% and higher while slowing the increasing costs of healthcare, housing and education.

When real growth returns, productivity will increase, and America Inc.'s empty tank will refill.