Story Highlights

- Most engagement drivers hinge on channel experiences

- Channel satisfaction creates brand ambassadors

- Financial leaders should make channel satisfaction a top priority

This is the first article in a .

Financial leaders whose banks offer great products and services, have strong brands, and deliver superior problem resolution may wonder: What's all this fuss about banking channels? Is customer satisfaction with channels all that matters in engaging them?

Not at all. Despite the myriad benefits of , there are many other factors banks can control that have the potential to enhance customer engagement.

However, without positive channel experiences, the power of these tactics can crumble. For financial industry leaders, attempting to improve customer engagement while overlooking channel experiences is likely a fruitless endeavor.

Potential Drivers of

Here are some other potential drivers of customer engagement -- each of which needs great channel experiences to be most effective.

Great products and services: While a bank's offerings need to be exemplary in their own right, the engagement gains that customer-centric products and services can provide rely on positive experiences with a bank's channels.

Purchasing and using financial products and services requires interacting with the bank in some way through a channel. Customers who are "very satisfied" with all channels they use tend to own more products from the bank than customers who are not very satisfied. In other words, channel satisfaction affects the number of products customers purchase.

Winning customers over with new, innovative products that differentiate a bank from its competition is a challenging task, and competitors may quickly copy new products. On the other hand, matching and delivering existing products to customers in ways that amplify those products' value is practical and often relatively easier. Ultimately, however good a bank's products are, its channel experiences need to be better.

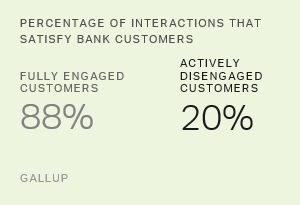

Strong : A bank's brand plays a prominent role in engaging its customers. However, employees must support and adequately convey the brand to customers across every channel. Customers who are very satisfied with all channels they use are 12 times more likely than customers who are not to say the bank "always delivers on what they promise."

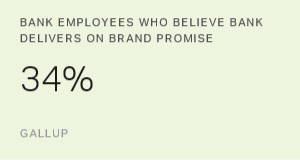

Unfortunately, many banks struggle to align employees with their brand. In one study, 优蜜传媒found that over half of bank employees (53%) could not even describe the bank's brand accurately and that just 34% said they believe the bank always delivers on its brand promise.

This is no small problem -- no amount of brand marketing will matter if customers' actual experiences do not align with the bank's messaging. This means that banks need to get their employees on board so that each channel interaction delivers on the bank's brand promise.

Effective problem resolution: Customer problems -- and how banks handle and resolve them -- have a major effect on customer engagement.

While effective problem resolution can turn threats into opportunities, it hinges on great channel experiences. Customers who are very satisfied with all channels they use are 10 times more likely than those who are not to say they can count on the bank to reach a fair and satisfactory resolution if a problem arises.

The problem-resolution journey starts with customers reporting their problems to banks through -- you guessed it -- bank channels. Although resolution often happens behind the scenes, every step of the journey (including apologizing for problems, providing progress updates and sometimes providing options for resolution) involves interacting with customers through a channel.

Therefore, without positive channel experiences, banks miss an opportunity to seriously enhance customer engagement when handling problems.

Ultimately, financial leaders need a well-rounded customer engagement approach -- one that employs a multitude of strategies. But as an overarching theme for customer engagement goals, banks need to make perfect channel experiences non-negotiable and provide five-star experiences each and every time.

The in this series will discuss how to deliver seamless channel experiences for bank customers.