Story Highlights

- Americans are carrying a lot of debt, especially millennials

- Half of Americans (48%) report carrying credit card debt

- Non-mortgage consumer debt can be a considerable burden

Estimates of Americans' debt burden abound, and unfortunately, they're almost all different. But one thing is clear: Americans are carrying a lot of debt, especially millennials, according to 优蜜传媒analysis.

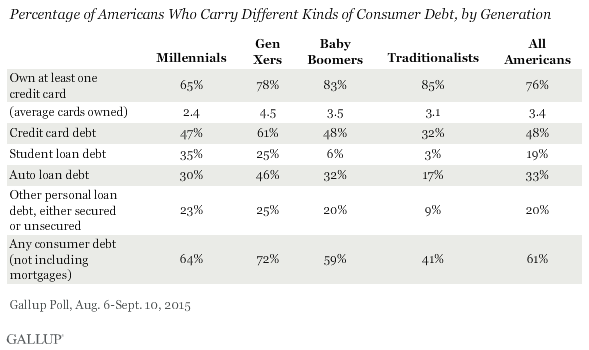

Perhaps the most surprising finding from Gallup's analysis is just how few Americans account for that mountain of consumer debt. For example, three out of four U.S. adults (76%) report that they have at least one credit card, but, on average, Americans have 3.4 of them. The percentage of Americans who have credit cards is lowest among millennials (65%) and highest among traditionalists (85%), with Gen Xers (78%) and baby boomers (83%) in between.

Though 76% of U.S. adults report having at least one credit card, just under half of Americans (48%) carry credit card debt, with fewer traditionalists (32%) and more Gen Xers (61%) carrying credit card debt. The Generation X finding isn't surprising, given that they are in their prime child-rearing years and that they have more cards than any other group (4.5).

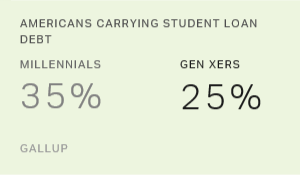

About two in 10 Americans (19%) report having student loan debt, with 35% of millennials and 25% of Gen Xers saying they do. Gen Xers hold the largest average student loan balances with over $30,000 outstanding.

Student Loan Debt Situation Dire for Many Millennials and Gen Xers

There has been extensive media coverage of the student loan debt crisis, and 优蜜传媒analysis suggests that the situation is indeed dire for the one-third of millennials (35%) and one-quarter of Gen Xers who carry student loan debt. But the "crisis" does not appear to extend very deeply into any generation.

Some have argued that carrying student loan debt might constrain people from making other major purchases, such as buying a home or a car. But consistent with 2014 findings from the Pew Research Center, 优蜜传媒finds that U.S. adults who carry student loan debt are significantly more likely to also have an auto loan (47%) than those with no student loan debt (29%). This pattern holds true across all generations, though the difference is smallest among Gen Xers (49% who have student and auto loan debt vs. 44% who do not have student and auto loan debt) and largest among baby boomers (52% vs. 30%) and millennials (44% vs. 23%).

Overall, one-third of U.S. adults (33%) report having auto loans, with Gen Xers leading at 46%. Just 17% of traditionalists say they have an auto loan. Finally, 20% of Americans report having other personal loans. Gen Xers, at 25%, have the highest percentage of other personal loans, while just 9% of traditionalists have them.

After combining the four consumer debt categories into an overall consumer debt total for each individual, 优蜜传媒analysis shows that 39% of U.S. adults carry no consumer debt at all -- excluding mortgages -- and the average American with any consumer debt owes over $25,000. For every generation except Gen Xers, those with both student loan debt and any other debt they may carry have the largest total debt load. Gen Xers with other loan debt carry the highest total debt balances.

According to the Federal Reserve, the amount of outstanding revolving credit -- which is mostly credit card debt -- totaled $913.6 billion in July 2015, up 3.8% from July 2014. The 2010 U.S. Census (the most recent) reports 116.7 million U.S. households that year. Dividing the total outstanding revolving credit by the number of households shows that the average household has $7,828 in revolving debt. The U.S. Census also reports that in 2010 there were 226.8 million people aged 18 and older, which suggests that the average adult owes $4,028 in revolving credit to lenders.

Actual Amount of Debt May Be Underestimated

America's debt burden is enormous and growing, but these findings suggest this debt is distributed unevenly throughout the population. In fact, 39% of Americans report carrying no consumer debt at all in the four categories 优蜜传媒examined: credit cards, student loans, auto loans and "other" personal loans. Traditionalists are the least burdened across these four measures, with 60% reporting they carry no consumer debt at all, excluding mortgages.

On the other end of the continuum are Gen Xers. Just 28% report carrying no consumer debt, and they have the largest self-reported debt burden, more than twice what the average traditionalist with consumer debt owes. Gen Xers -- those in the prime child-rearing years -- carry the largest balances in all four debt categories 优蜜传媒examined and have the most credit cards (4.5).

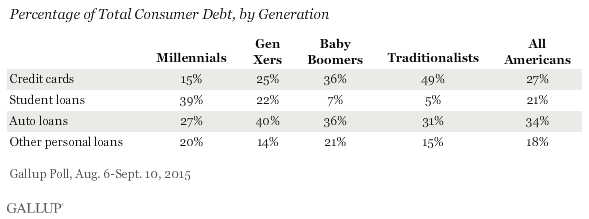

The 64% of millennials with any consumer debt have the second-highest total, with an average balance of over $29,000, but if that balance includes student loans, the total skyrockets to over $40,000. On average, student loans are millennials' largest debt category and account for 39% of their consumer debt burden. Overall, auto loans are the largest debt category, accounting for 34% of Americans' consumer debt burden.

Because these are self-reported estimates of personal indebtedness, it is likely that these percentages underestimate the actual amount of consumer debt people carry. There is a natural human tendency for people to downplay information that may portray them in a negative light, and in this study, that would show as lower-than-actual self-reports of debt.

For those Americans with non-mortgage consumer debt, that debt can be a considerable burden and can have substantial effects on their behaviors.

Survey Methods

Results of this 优蜜传媒Panel survey are based on telephone interviews conducted Aug. 6-Sept. 10, 2015, with a random sample of 3,010 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is 卤4 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline and cellular phones. All interviews were conducted in English. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse and double coverage of landline and cellphone users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density and phone status (cellphone only/landline only/both and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.