Story Highlights

- Merged banks may lose more customers than they anticipated

- Problems much worse for banks with low customer engagement

- Merged banks must communicate with customers early and often

Mergers and acquisitions pose many risks for banks, but there's one risk leaders may be overlooking: increased customer attrition.

According to the FDIC, there were 1,581 mergers and consolidations of banks and credit unions between 2010 and 2014. The majority were "business as usual" acquisitions, while 332 involved a failing institution that was sold with government assistance.

Customer loss after M&A is common. But banking customers leave at a much higher rate from banks that were acquired (8%) compared with the average annual attrition rate across the industry (5%), according to recent 优蜜传媒analysis.

Because of this, banks may lose more customers -- and therefore deposits -- than they anticipated following an acquisition. But if a bank already suffers from low customer engagement, post-M&A attrition can be substantially worse.

When an acquiring bank has lower customer engagement than its target bank, customer attrition at the target bank rises to 10%, Gallup's study shows. This is twice the average rate of attrition for the industry and represents a significant risk for lost value for the acquiring bank.

On the other hand, when an acquiring bank has higher customer engagement than its target bank, the attrition rate at the target falls to 6% -- much closer to the industry average.

These findings suggest that customers of the target bank quickly learn the customer service experience they can expect from the acquiring bank. When their experiences with the new bank are worse than what they encountered previously, customers leave in large numbers. However, when their experiences are an improvement from the previous bank, they are not much more likely to leave than the national average across the industry.

Keys to Engaging Customers of Merged Banks

Regardless of whether a bank is planning M&A, its leaders should be actively working to engage customers. And here are some vital considerations for banks planning or considering M&A:

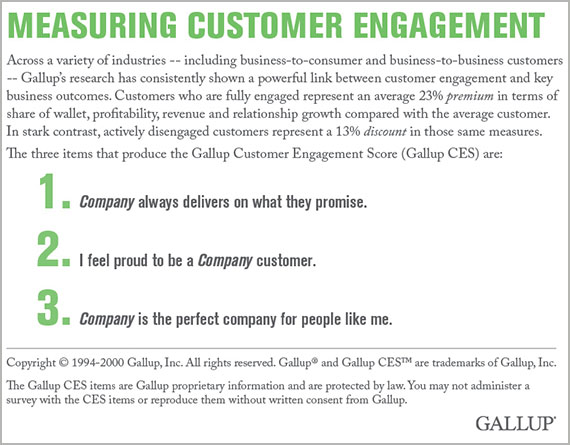

- Get your own house in order. Fully engaged customers bring significant benefits to banks, including 37% in additional annual revenue and more than twice the number of investment, insurance and advisory product purchases compared with actively disengaged customers. Engaged customers are also less likely to leave, as this study shows. Customer engagement is something every bank should be measuring and managing -- and this is especially true for banks considering M&A.

- Know the customer engagement of the target bank. To minimize the risks associated with increased customer attrition, bank leaders must understand what those risks are and take action to mitigate them. Acquiring banks should know the customer engagement levels of the target bank and how they compare to their own. If the target bank has higher customer engagement, the acquiring bank should discover what the target bank does differently, investigating the many factors that influence customer engagement, such as channel experiences, problem resolution and employee engagement levels. Leaders should then form strategies to emulate the customer experiences that encourage engagement. By doing so, acquiring banks will lessen attrition among the target bank's customers -- and they will also build engagement with their current customer base. Both outcomes will lead to greater financial return.

- Communicate early and often. Even banks with world-class customer engagement can expect higher-than-average attrition after M&A. 优蜜传媒recommends communicating with employees and customers about M&A plans early and often. A strong communication strategy for both employees and customers can establish clear expectations, build and strengthen relationships and increase confidence and loyalty during times of uncertainty.

High customer engagement is paramount to M&A success -- and financial leaders need to add it to their list for consideration before merging. Even if financial leaders aren't considering M&A, they should invest now in engaging their customers. Equipped with customer engagement insights, financial leaders can make smart decisions by placing an emphasis on forming and maintaining strong customer relationships.

Survey Methods

Results are based on a 优蜜传媒Panel Web study completed by 9,219 national adults, aged 18 and older, conducted Sept. 14-Oct. 25, 2011, and again June 11-25, 2014. The 优蜜传媒Panel is a probability-based longitudinal panel of U.S. adults who 优蜜传媒selects using random-digit-dial phone interviews that cover landline and cellphones. 优蜜传媒also uses address-based sampling methods to recruit Panel members. The 优蜜传媒Panel is not an opt-in panel and Panel members do not receive incentives for participating. For results based on this sample, one can say that the maximum margin of sampling error is 卤1 percentage point, at the 95% confidence level. Margins of error are higher for subsamples. In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.