Last year, Alan Starling fired the shot heard 'round the auto industry world. Starling, then-chairman of the National Automobile Dealers Association, described customer satisfaction index (CSI) measurement -- the system and approach commonly used by automakers -- as "broken" and in dire need of fixing.

Starling was summarizing the conclusions of an auto dealer forum that decried the use of lengthy and cumbersome customer surveys. In most cases, those surveys were full of poorly worded questions that focused on issues with little or no proven relevance to auto owners. Moreover, the dealers contended that CSI systems, which are intended to enhance dealer performance, are essentially useless. Dealers, they felt, wind up focusing on how to increase their scores while losing sight of the real goal: better customer service.

Are these just sour-grapes reactions from the recipients of CSI reports? Don't these report cards simply relate the honest complaints of concerned customers? Apparently not. And auto dealers aren't the only ones dissatisfied with satisfaction measurement programs.

According to the Bain consultancy's global "Management Tools" survey, as of the year 2000, only a quarter (25%) of the executives in companies using customer satisfaction measurement were "extremely satisfied" with their measurement programs. To underscore their disenchantment, over the previous seven years, there was a drop of 26 percentage points in the number of companies using some form of satisfaction assessment.

Fixing what's broken

Part of the reason for the decline in use of -- and enthusiasm for -- customer satisfaction measurement stems from the measurement process itself. Too many measures of unknown and unproven worth are piled on customers whose time is at a premium and whose response rates may thus be declining. And in the auto industry as elsewhere, too many dealers are "gaming" the system -- coaching customers to the point where the dealer's scores may simply reflect the pressure put on customers to give top box ("5") ratings on whatever is being measured.

And regardless of the particular CSI measurement system in place, there can be little zeal for systems that don't provide company managers with new insights and useful guidance. There is often very little "spread" in the obtained satisfaction ratings; most reports indicate that competing brands are merely a few percentage points apart. These reports don't shed much light on existing brand-versus-brand (let alone dealer-versus-dealer) differences.

Beyond these measurement problems, however, there's another major reason for the lack of return on investment -- and the resulting corporate disenchantment with customer perception measures. Many of these programs are simply misdirected. First of all, they don't aim high enough. They measure customer "satisfaction," which has been shown to be an insufficient indicator of relationship strength. (See "Customer Satisfaction Doesn't Count" in See Also.)

In addition, too many programs direct their energies toward reducing defects, emphasizing outcomes such as "problems per hundred vehicles." Enduringly passionate brand relationships require more than just a dearth of defects. By focusing on reducing product or dealer deficiencies, companies can easily overlook or ignore the crucial factors that define a long-term and profitable relationship.

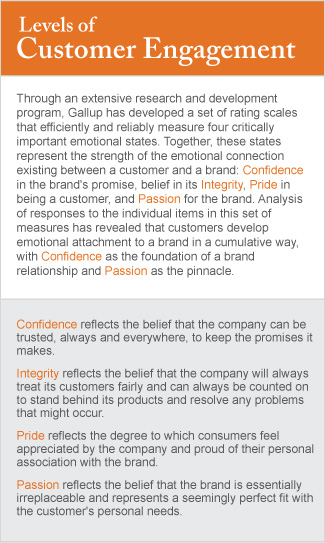

As reported in other GMJ articles, although customer connections may be grounded in Confidence and Integrity, these levels represent only the base of a relationship. They're essential, but they're insufficient. (See graphic "Levels of Customer Engagement"; see "Why Car Buyers Buy," "Getting Emotional about Brands," and "Building a Brand Relationship" in See Also.)

Strong brand connections require an emotional bond that extends well beyond this foundation to include the essential feelings of Pride and Passion. Without these positive emotional links, any brand relationship remains vulnerable.

Don't satisfy -- engage

Customer engagement represents a much more meaningful outcome than satisfaction for an auto dealer, just as it has proven to be a more meaningful outcome for a clothing retailer, a grocer, or a banker. (See "The Constant Customer" in See Also.) "Customer engagement" is a measure of the overall strength of a company's customer relationships; it reflects the degree to which customers have formed emotional as well as rational bonds to the brands they buy and own. And customer engagement measures reveal not only the importance of reducing defects and solving problems, but also the clear payoff of brand Passion. What's more, it can be measured -- and managed.

Customer engagement is not just a sensitive detector of brand-versus-brand differences; it has been shown to be a bellwether measure of the store-level and dealer-level differences that greatly affect the company's total profit performance. As a result, it overcomes one of the more contentious and problematic shortcomings of CSI. Unlike CSI, customer engagement measurement focuses a manager's attention on factors that matter. These factors matter to customers, and as a direct result, they matter to managers.

For example, in 优蜜传媒Organization studies of customer engagement, we found that one bank's "fully engaged" customers maintained balances that were 26% greater than their less engaged counterparts. We found that a grocery chain's fully engaged customers visited the store 20% more often and spent 33% more than those who were actively disengaged. For a leading retailer, we found that retail outlets with customer engagement levels that were in the top half achieved per-store sales that were 11% higher than stores with customer engagement that was in the lower half.

And we've found that car dealers who perform well on customer engagement also reap real benefits, with profit margins in one case that were 11% greater than dealers whose customer engagement scores were relatively low.

That's the way to re-establish measurement credibility with car dealers: by demonstrating that customer relationship measures relate clearly and directly to outcomes that matter -- and for which they should be held accountable. Refocusing car dealers -- or bank branch managers, or retail store managers -- on a small set of meaningful metrics (as provided, for example, by Gallup's 11-item customer engagement index, the CE11) is a first step to establishing long-term relationships with customers. A measure like CE11 also meets the challenge set forth in Starling's speech to the Detroit Automotive Press Association: It provides a credible customer relationship measure that can assist dealers seeking to strengthen their customer connections.

It's time for the auto industry to move away from what's broken toward a system that will aid dealers and their customers. They can no longer be satisfied with mere satisfaction.