Before becoming president, Andrew Jackson was a military hero and major general -- someone who waged his fair share of battles against many different opponents. Today, Jackson spends his time on the $20 bill while the nation's retailers fight an ongoing battle to make sure his face remains a ubiquitous presence in their stores.

Apparel and accessories retailers that fail to engage their customers, ÆéûÜǨû§finds, wave goodbye to sales premiums equal to $20, on average, for every $100 transaction. But retailers can win the war for shoppers' wallets -- despite the recent economic upheaval -- by embracing a sound customer retention strategy built on increasing engagement.

Recently, there have been signals that the U.S. economy is improving. Nevertheless, it doesn't take an expert in economics to understand the drastic changes and challenges that the retail industry has faced since the beginning of the recession in December 2007. Consumers across the United States have altered their habits when purchasing products from accessories to formal wear and from meals in restaurants to vacations abroad. They are shopping less often and buying less when they do shop -- with specific merchandise categories and types of retailers feeling the pinch more so than others. These conclusions are evident when comparing Gallup's 2009 Clothing and Apparel Retail survey results to the findings from the same survey conducted in 2007.

U.S. consumers have altered their habits when purchasing products from accessories to formal wear and from meals in restaurants to vacations abroad.

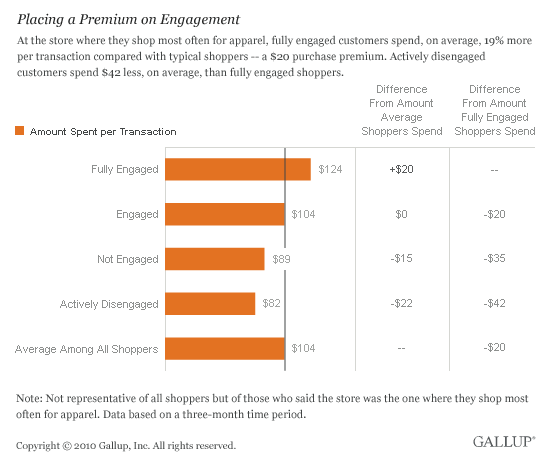

A key finding of the survey results -- one supported by years of similar research into customer service -- is the importance that survey respondents place on the customer experience: Customer experience is the reason they shop where they do. Specifically, ÆéûÜǨû§finds that consumers prefer stores based more on the quality of their customer service efforts and the ease of shopping they offer than on the uniqueness of the clothes they sell or their reputation as a great place to buy the basics. Gallup's research also finds that fully engaged customers spend $20 more per transaction than average customers at the same stores. Retailers' most effective strategy for fending off competitors is focusing on creating an emotionally engaging experience for their customers.

Retailers fighting multiple battles

Reports of a decline in U.S. retail sales in December 2009, coupled with a 6.2% decrease in retail sales for the entire year, fuel frustration felt by companies trying to bounce back from the recent economic downturn. And a comparison of Gallup's panel research of the clothing and apparel retail industry in 2007 and 2009 confirms the challenge facing retailers of every ilk: There is plenty of room for improvement in a host of areas.

Consumers took slightly fewer apparel shopping trips on average in 2009 (4.0 during a three-month window) as they did in 2007 (4.2 during the same timeframe). But when they went to the register with clothing in hand, consumers spent 13% less during the average transaction in 2009 than they did in 2007.

The shift in the economic climate no doubt affected some retailers more than others. From 2007 to 2009, ÆéûÜǨû§found that respondents shopped significantly less often at department and specialty stores, but the drop was not as precipitous at general merchandise, discount, and online retailers. It appears that consumers are concentrating more energy -- and more wallet share -- on buying the essentials. The largest drop in sales was in formal business attire and athletic wear -- two categories that, for many individuals, aren't "must-have" apparel.

Battling for wallet share

With consumers' budgets tight and sales sagging, retailers must capitalize on the shoppers who are buying from their stores. ÆéûÜǨû§research finds that during a three-month timeframe at the store where they shop most often for apparel, fully engaged customers spend an average of 19% more per transaction compared with typical shoppers -- a $20 purchase premium. Retailers that fail to create an emotional connection with people who are already making purchases in their stores are taking the amount their shoppers spend for granted -- to the tune of $20. The penalty is even stiffer when customers are actively disengaged but continue to shop at a store: Actively disengaged customers spend $42 less, on average, than fully engaged shoppers. (See graphic "Placing a Premium on Engagement.")

How can retailers engage shoppers?

Based on responses to Gallup's semi-annual retail survey from a cross-section of more than 44,000 Americans, we found that customer service tops the list of a dozen potential drivers of customer engagement. That's right: A store's customer service had greater influence on customer engagement than attributes such as the fashion and versatility of the clothing, high quality, or the range of styles available. Being "easy to shop" and "offering good quality for the price" also rank high, while being "great for basics" and "great sales" languish at the bottom of the list. Retailers can't just buy customers with low prices on items they don't want, and customers are looking for more than just basics to differentiate their retailer of choice.

However, customers aren't engaging with stores based on traditional modes of customer service, especially under current economic conditions. Some retailers might not consider problem resolution and sincerely thanking shoppers to be key elements of customer service, but these are areas they cannot afford to ignore.

Far too many retailers think that the service provided by a harried call-center employee answering complaints is enough to meet customers' service expectations. Instead, they must consider service as the entire in-store customer experience, encompassing all of the characteristics, impressions, and interactions that the retailer can influence. Short-changing these experiences can keep a store from engaging its customers -- and keep a retailer from realizing that $20 premium.

Far too many retailers think that the service provided by a harried call-center employee answering complaints is enough.

Gallup's customer research suggests that there are six tactics that can create the kind of emotional connections that win customers' hearts and wallets. Retailers can differentiate their brands by addressing these crucial points -- and by employing other key strategies such as hiring friendly, available, and knowledgeable associates and offering customers an easy shopping and transaction experience.

To survive -- and perhaps even thrive -- in the current economy, retailers must articulate their value for customers and give them a reason to shop the brand. They also must convey a reason why their products or services are integral to the customers' lifestyle. Offering the right product at the right time at the right price is just the first step to engagement; retailers that incorporate the following tactics in their customer engagement strategy can fortify their position in the ongoing battle for wallet share.

Six Tactics for Engaging Customers

|

In the struggle to secure the $20 premium that each engaged customer can bring to the cash register, retailers must commit to creating a culture that makes the customer experience a top business concern. They must bolster their forces by hiring the right workers -- people they can trust and count on to foster an indelible engagement between customers and the business. And retailers must execute a battle plan that includes the six tactics for engaging customers. These approaches and behaviors can help retailers win the war for wallet share -- and in a way that would make Andrew Jackson proud to show his face in their stores.

Survey Methods

Results are based on a ÆéûÜǨû§Panel study and are based on mail and web surveys completed by 44,162 national adults, aged 16 and older, conducted in April and May 2009. ÆéûÜǨû§Panel members are recruited through random selection methods. The panel is weighted so that it is demographically representative of the U.S. adult population. For results based on this sample, one can say with 95% confidence that the maximum margin of sampling error is ôÝ1.0 percentage points. Margins of sampling errors vary for individual subsamples. In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.