The current economic situation would be a lot easier to accept if it wasn't totally baffling. Companies that appeared to be an inch from bankruptcy a year ago now seem to be turning enormous profits. Wall Street is booming. Goldman Sachs is getting ready to pay out record bonuses.

But Main Street businesses are struggling, and many small businesses can't get the credit they need. Consumers aren't spending. Some companies are hiring, while others are cutting jobs, hours, and wages. Still, the U.S. Department of Labor just reported the smallest job loss since the recession began and a drop in the unemployment rate from 10.2% to 10.0%. It's a "through-the-looking-glass" sort of economy -- and when economics starts resembling fiction, there might be something wrong.

You see so many contradictory things occurring right now because there's a lot of artificiality in the global economy.

And fiction is exactly what is wrong with the economy, says Dennis Jacobe, Ph.D., Gallup's chief economist. Much of the economy is based on what he calls "artificiality." This unnatural tinkering with the economy likely staved off a second Great Depression. But it also has created some false economic signals, he says, and they shouldn't be confused with reality.

For that reason, Dr. Jacobe has some words of warning, which he shares in the following conversation. These include: To survive financially right now, consumers and businesses alike need to build a "fortress balance sheet." Be wary of Wall Street as a measure of the economy -- it has become decoupled from Main Street and isn't a reliable barometer of the economy. And last but certainly not least, he forecasts that the economic environment won't genuinely be better until the middle of next year when the jobs situation should begin to improve.

GMJ: The stock market is up -- the S&P 500 has risen more than 60% since March. But November retail sales were much weaker than expected, and even after a surprisingly good jobs report, the unemployment rate is still at 10% -- and it's more like 17% if we count the underemployed and the people who've given up looking for a job.This doesn't seem to make any sense. Can you explain why this is happening?

Dr. Jacobe: The reason that you see so many contradictory and unusual things occurring right now is that there's just a lot of artificiality in the global economy. As a result, many of the economic measures and relationships that we normally depend on to forecast the future direction of the economy may not hold true in this new environment. We've just gone through the worst financial crisis since the Great Depression, and economies don't recover from that kind of thing overnight.

What led to this artificiality was that governments and monetary institutions around the world, led by the U.S. Federal Reserve, took unprecedented actions to mitigate the effects of the financial crisis. The Fed put trillions of dollars into the U.S. economy, bailing out Fannie Mae, Freddy Mac, AIG, and other financial institutions. When you factor in the actions taken by other governments in addition to the U.S. efforts, an enormous amount of liquidity was thrown into the global economy to stabilize the financial sector.

In addition, the United States has undertaken an unprecedented amount of spending, ranging from TARP [the Troubled Asset Relief Program] and the auto industry bailout to the stimulus program and expansion of the social safety net. As a result, future federal budget deficits are also going to be unprecedented for years to come. Combined, these fiscal and monetary policies have led to sharp declines in the value of the dollar, a surge in commodity prices, and even serious questions about the role of the dollar in the global economy.

All of this seems to have worked in the short term, and the world economy is much better off in terms of its financial stability than it was a year ago. But these actions created all sorts of unusual new relationships in the world economy. A lot of what we're currently seeing is more of a mirage than reality -- and people should be wary of the false signals that may have come from these emergency actions. In a sense, we've put the global economy on "steroids" -- and we know there will be long-run consequences -- but even more importantly, we know these "steroids" are creating distortions in our normal measures of global economic well-being.

GMJ: What do you mean by "false signals"?

Dr. Jacobe: For example, the value of the U.S. dollar has fallen sharply this year. As a result, you're seeing some pick-up in U.S. export industries. In turn, this benefits Wall Street, as global companies are doing better and U.S. stocks are a lot cheaper on a global basis than they used to be. So Wall Street is doing relatively well even as the value of the dollar plunges. What's more, the cheap U.S. currency has increased the oil prices and commodity prices that are valued in dollars, so the stocks in those areas have done comparatively well.

The dollar can't keep going down in value without having negative economic effects.

The Fed's willingness to let the dollar decline has artificially stimulated a whole lot of areas, particularly commodities. Economists can debate whether it's a bubble or not, but at least in theory, the dollar can't keep going down in value without having some significant negative economic effects on the overall U.S. economy, particularly in terms of inflation. Nations simply can't devalue their way to economic prosperity.

GMJ: So why is the U.S. economy not experiencing more inflation?

Dr. Jacobe: U.S. inflation is being held down because we're getting a lot of our goods from Asian countries that have pegged their currencies to the U.S. dollar. Of course, this artificial relationship can't go on forever.

The continuous decline in the value of the dollar has investors around the world looking for some place to invest that will provide them a "store of value." These investors are basically losing money if they continue to hold their investments in the dollar as its value declines. So they are investing in gold and oil and other commodities because as the dollar declines, those things maintain or go up in value.

One of the most obvious fallouts of this new store-of-value aspect being attached to commodities is currently being reflected in oil and gas prices. Given the record high levels of oil supplies around the world, I don't believe oil prices reflect market conditions of supply and demand, nor have they done so for some time. As a result, Americans are paying a lot more for gas at the pump right now than they were a year ago -- and there is no justification for this in terms of market fundamentals.

GMJ: What's wrong with that?

Dr. Jacobe: Nothing, necessarily. Gold and other precious metals have always been essentially a store of value and a hedge against inflation and currency devaluation. But, most other commodity prices like that of oil have been determined, at least to a large degree, by supply and demand. Many such prices no longer seem to be determined that way. Once a commodity also becomes a money substitute, its price becomes somewhat artificial as it is separated from the market forces of supply and demand.

Of course, there are many things happening in the U.S. economy that are also producing artificial results. Much of the U.S. economic growth in the third quarter was the result of the "cash for clunkers" program and new home buyer tax credits. Interest rates remain artificially low despite sharply increased levels of government spending, because the Fed is injecting enormous amounts of liquidity into the economy. So far, we're not seeing the kind of inflation that would normally result from this monetization of fiscal spending because of weak consumer demand and all the global imbalances we discussed earlier.

Further, as government takes a larger and growing role in the U.S. financial markets and overall economy, market forces tend to become increasingly distorted. Government actions can create "economic illusions" that can be just as difficult, if not more so, to deal with and understand as the "economic bubbles" of recent years. The good news is that we've avoided economic catastrophe, and that's something to celebrate.

GMJ: I don't see you throwing confetti.

Dr. Jacobe: There are still reasons to be cautious right now. I think consumers, businesses, and investors must understand that although we'll likely be much better off a year from now, you have to be really careful about how you interpret what's happening in the U.S. and global economy. There is still a good chance we'll see a double-dip -- another quarter or two of negative economic growth -- in the U.S. economy before we see full recovery. Consumers and businesses must be very, very careful right now.

GMJ: Careful in what way?

Dr. Jacobe: My advice is that Americans should go back to some of the old financial principles as they pursue both their personal and business lives. Consumers need to build a fortress balance sheet. Individuals should do everything they can to make sure they've got a manageable debt load. They should build up an emergency fund -- savings that can last them from three to six months in case something happens to the employment in their household or if something else unexpected occurs. If they buy a home, they should buy it with a significant down payment and a reasonable relationship between their monthly payments and their household income.

If your company or organization makes investments, make sure you need them and can pay for them. You want to have a strong enough balance sheet that if economic forces outside of your company's control have a negative effect, your business can handle things financially and continue to survive. Maybe just make a new year's resolution that you'll end 2010 with less debt and more savings than you did in 2009.

GMJ: The economy is expanding again, but unemployment is still hovering at 10%. Why is that?

Dr. Jacobe: Unemployment generally is a lagging indicator, so it's normal for the unemployment rate to continue to get worse even as the economy recovers somewhat. If you look at Gallup's Job Creation Index, which is more of a coincident indicator than a lagging indicator like the unemployment rate, it shows that the job market has bottomed out.

Our data show that fewer companies are letting people go, but new hiring is not taking place. That makes a lot of sense -- because business remains uncertain about the future and as a result, continues in survival mode. The layoffs of the past couple of years have been very difficult for everyone, and companies simply don't want to take on new workers if they're not sure they need them.

GMJ: It seems very difficult to find a job in this market.

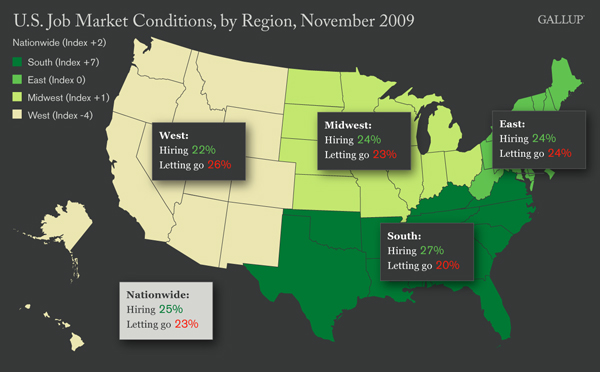

Dr. Jacobe: It's a complex dynamic, and I think people sometimes misunderstand it. Companies are constantly hiring and laying off employees. Somewhere around a quarter of the country's businesses tell us they're still hiring even today. The problem is that just about as many companies are laying people off. And it varies by region. Right now, the South is the strongest region in the country when it comes to hiring.

So even though current job market conditions are dismal by almost any standard, looking for a job is not a hopeless enterprise. There are jobs out there; you just have to find one that you fit into. But that's hard -- and depending on the industry you're in, it can be a long, difficult transition process. That's why I think consumers need to build a fortress balance sheet, starting with three to six months' worth of salary in savings. Not many Americans have an emergency fund like that, but that's what's needed in the world we're living in today -- the "new normal."

GMJ: When do you think the employment situation will begin to improve?

Dr. Jacobe: Well, I wouldn't read too much into the November jobs report. I think we'll see the unemployment rate continue to increase into the middle of next year. Job losses for the economy as a whole are likely to end before that point, but the unemployed and underemployed on Main Street probably won't see much improvement before mid-year.

If the unemployment rate remains above 10% and Main Street continues to lose hope, the political panic will become overwhelming.

GMJ: Should we consider Wall Street an accurate barometer of the health of the economy right now -- or at all?

Dr. Jacobe: Absolutely not.

GMJ: That's going to come as a surprise to a lot of people on cable news shows.

Dr. Jacobe: Yes. There's a longstanding idea that not long after Wall Street begins to improve, the U.S. economy will do likewise. And there are some technical things that tend to validate that over time. But I think that what's happening on Wall Street has become significantly decoupled from the realities on Main Street. Just because Wall Street is doing well, it doesn't mean Main Street will do so.

GMJ: I was hoping for more optimism, given the recent jobs report -- and the holiday spirit.

Dr. Jacobe: Despite all my concerns about today's illusory economic environment, I think there is reason for optimism as we head into 2010. My reasoning involves a little bit of political and economic double-think, but let me try it on you.

The U.S. economic system has been and continues to be the most powerful engine of economic prosperity ever devised. The U.S. political system remains the most representative and responsive such system in the world.

Right now, I think we have a jobs crisis in the U.S. Even though there was good news in the November unemployment report, it also showed that an additional 100,000 Americans got discouraged during the month and dropped out of the labor force. And, it showed that many of the new jobs being created are part-time. My point is that there is no reason to celebrate a 10% unemployment rate.

My guess is that around one in five Americans are currently unemployed, underemployed, or simply too discouraged to look for work. U.S. society can tolerate this situation for a relatively short period of time -- but not for years, as the Fed and others have suggested may need to be the case.

GMJ: Given the current state of the economy, what actions should government leaders -- and individuals -- take to keep the economy moving forward in 2010 or to build that fortress balance sheet?

Dr. Jacobe: In this regard, I think the president's economic summit was probably a step in the right direction, but one that was not executed in the way I think is necessary. What we need now is a broad consensus about how we prioritize and create jobs in this country -- and that needs to involve everyone across the political spectrum.

Although I know it doesn't seem likely right now, I think there is a reasonably good chance that we'll see real and effective action on the jobs front next year. With 2010 being a midterm election year, conventional political wisdom tends to be that little will be accomplished in the nation's capital. But I think next year could well be an exception.

If the unemployment rate remains above 10% and Main Street continues to lose hope -- recent ���۴�ýdata show that one in three Americans say things will be better a year from now -- then I think the pressure and political panic will become overwhelming as each month passes next year. This may be the best chance we've had in many years for the politicians to put aside ideology and seek consensus about how we can get job creation happening in the United States. And, I think there is a lot more agreement about what can be done to create "real" rather than "illusory" jobs than it seems right now, particularly in such areas as education and infrastructure. Of course, if I'm mistaken, then the new group in the nation's capital in 2011 will be elected to achieve such a consensus.

So, my advice for 2010 is make a new year's resolution to reduce your debt and increase savings, because that's the best way to handle today's illusory economy. And be hopeful -- because job creation is going to be the nation's top priority next year.

-- Interviewed by Jennifer Robison